Answered step by step

Verified Expert Solution

Question

1 Approved Answer

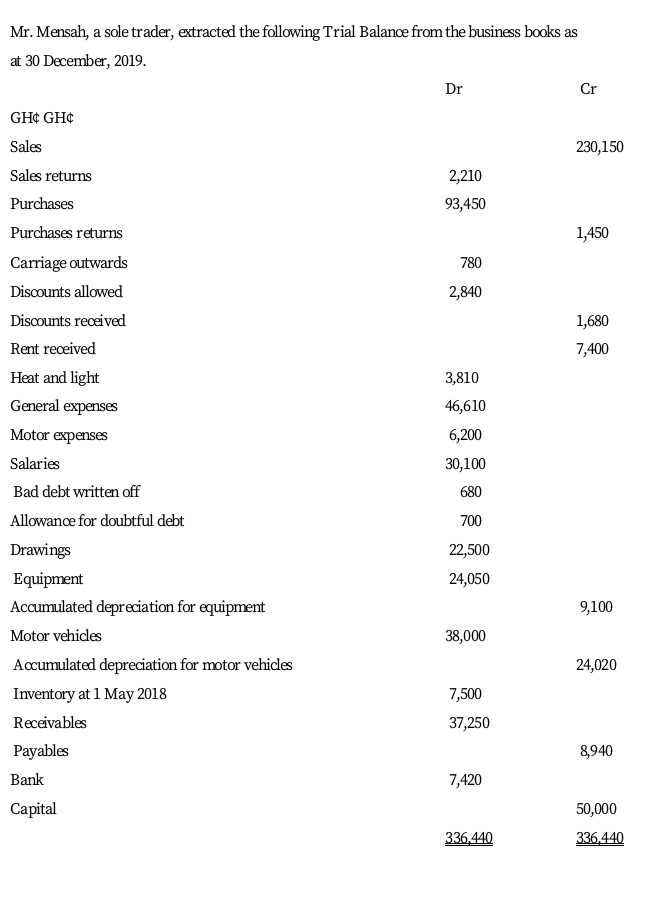

Mr. Mensah, a sole trader, extracted the following Trial Balance from the business books as at 30 December, 2019. Dr Cr GH GH Sales 230,150

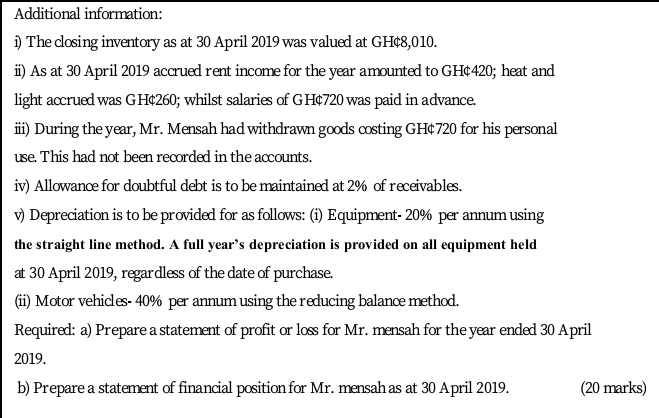

Mr. Mensah, a sole trader, extracted the following Trial Balance from the business books as at 30 December, 2019. Dr Cr GH GH Sales 230,150 2,210 93,450 1,450 780 2,840 1,680 7,400 Sales returns Purchases Purchases returns Carriage outwards Discounts allowed Discounts received Rent received Heat and light General expenses Motor expenses Salaries Bad debt written off Allowance for doubtful debt Drawings Equipment Accumulated depreciation for equipment Motor vehicles Accumulated depreciation for motor vehicles Inventory at 1 May 2018 Receivables Payables Bank Capital 3,810 46,610 6,200 30,100 680 700 22,500 24,050 9,100 38,000 24,020 7,500 37,250 8,940 7,420 50,000 336.440 336.440 Additional information: 1) The closing inventory as at 30 April 2019 was valued at GH8,010. ii) As at 30 April 2019 accrued rent income for the year amounted to GH420; heat and light accrued was GH260; whilst salaries of GH720 was paid in advance. ii) During the year, Mr. Mensah had withdrawn goods costing GH720 for his personal use. This had not been recorded in the accounts. iv) Allowance for doubtful debt is to be maintained at 2% of receivables. ) Depreciation is to be provided for as follows: (i) Equipment- 20% per annum using the straight line method. A full year's depreciation is provided on all equipment held at 30 April 2019, regardless of the date of purchase. (ii) Motor vehicles- 40% per annum using the reducing balance method. Required: a) Prepare a statement of profit or loss for Mr. mensah for the year ended 30 April 2019. b) Prepare a statement of financial position for Mr. mensah as at 30 April 2019. (20 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started