Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mr Mrembo, a family friend of your family, owns a company called Mrembo Sales. Mr Mrembo knows that your favourite subject at the University

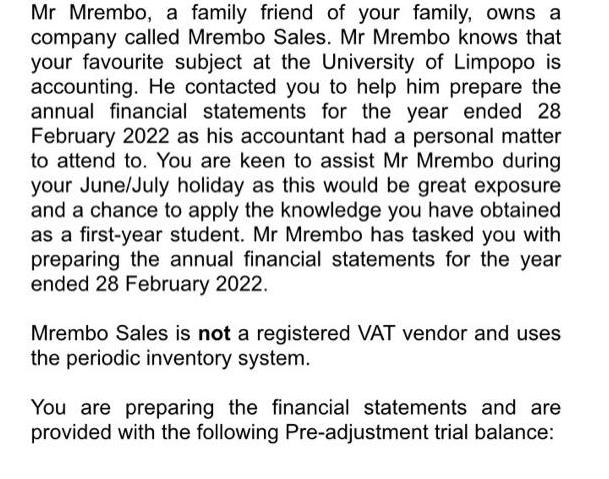

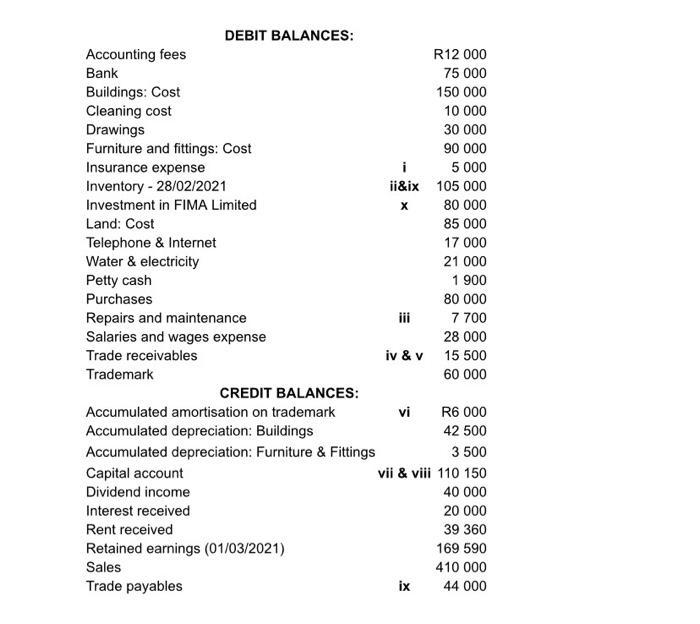

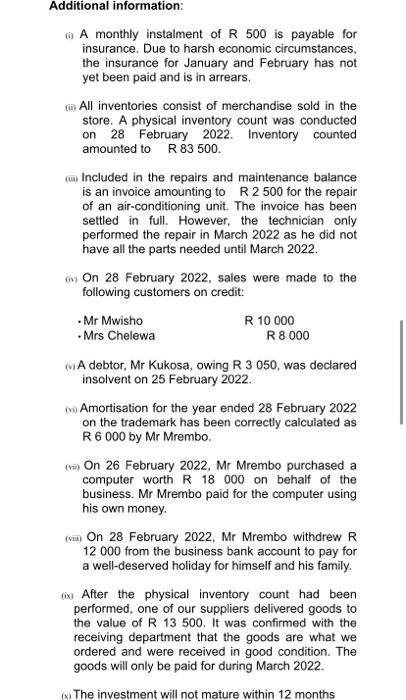

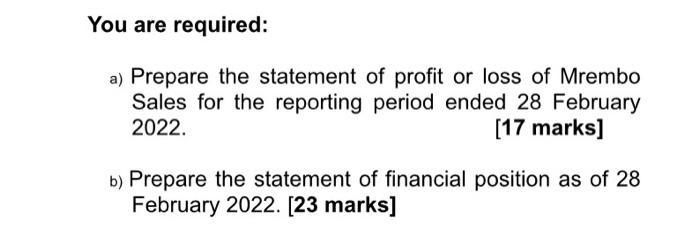

Mr Mrembo, a family friend of your family, owns a company called Mrembo Sales. Mr Mrembo knows that your favourite subject at the University of Limpopo is accounting. He contacted you to help him prepare the annual financial statements for the year ended 28. February 2022 as his accountant had a personal matter to attend to. You are keen to assist Mr Mrembo during your June/July holiday as this would be great exposure and a chance to apply the knowledge you have obtained as a first-year student. Mr Mrembo has tasked you with preparing the annual financial statements for the year ended 28 February 2022. Mrembo Sales is not a registered VAT vendor and uses the periodic inventory system. You are preparing the financial statements and are provided with the following Pre-adjustment trial balance: DEBIT BALANCES: Accounting fees Bank Buildings: Cost Cleaning cost Drawings Furniture and fittings: Cost Insurance expense Inventory - 28/02/2021 Investment in FIMA Limited Land: Cost Telephone & Internet Water & electricity Petty cash Purchases Repairs and maintenance Salaries and wages expense Trade receivables Trademark CREDIT BALANCES: Accumulated amortisation on trademark Accumulated depreciation: Buildings Accumulated depreciation: Furniture & Fittings Capital account Dividend income Interest received Rent received Retained earnings (01/03/2021) Sales Trade payables i ii&ix X iv & v vi R12 000 75 000 150 000 10 000 30 000 90 000 5 000 105 000 80 000 85 000 17 000 21 000 1 900 80 000 ix 7 700 28 000 15 500 60 000 R6 000 42 500 3 500 vii & viii 110 150 40 000 20 000 39 360 169 590 410 000 44 000 Additional information: A monthly instalment of R 500 is payable for insurance. Due to harsh economic circumstances, the insurance for January and February has not yet been paid and is in arrears. (i) All inventories consist of merchandise sold in the store. A physical inventory count was conducted on 28 February 2022. Inventory counted amounted to R83 500. (Included in the repairs and maintenance balance is an invoice amounting to R 2 500 for the repair of an air-conditioning unit. The invoice has been settled in full. However, the technician only performed the repair in March 2022 as he did not have all the parts needed until March 2022. () On 28 February 2022, sales were made to the following customers on credit: - Mr Mwisho .Mrs Chelewa R 10 000 R 8 000 A debtor, Mr Kukosa, owing R 3 050, was declared insolvent on 25 February 2022. (v) Amortisation for the year ended 28 February 2022 on the trademark has been correctly calculated as R6 000 by Mr Mrembo. (vii) On 26 February 2022, Mr Mrembo purchased a computer worth R 18 000 on behalf of the business. Mr Mrembo paid for the computer using his own money. (vii) On 28 February 2022, Mr Mrembo withdrew R 12 000 from the business bank account to pay for a well-deserved holiday for himself and his family. After the physical inventory count had been performed, one of our suppliers delivered goods to the value of R 13 500. It was confirmed with the receiving department that the goods are what we ordered and were received in good condition. The goods will only be paid for during March 2022. (x) The investment will not mature within 12 months You are required: a) Prepare the statement of profit or loss of Mrembo Sales for the reporting period ended 28 February 2022. [17 marks] b) Prepare the statement of financial position as of 28 February 2022. [23 marks]

Step by Step Solution

★★★★★

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Mrembo Profit Loss Statement For Year Ended 28022022 Sales Income 42800000 Cost of sales opening Inv...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started