Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mr Ntini is a newly qualified attorney and has decided to open his own practice. He is planning on running a very successful practice,

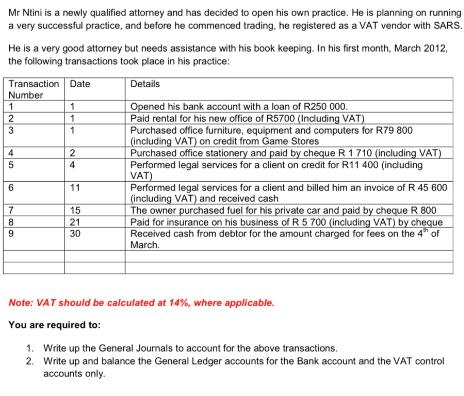

Mr Ntini is a newly qualified attorney and has decided to open his own practice. He is planning on running a very successful practice, and before he commenced trading, he registered as a VAT vendor with SARS. He is a very good attorney but needs assistance with his book keeping. In his first month, March 2012, the following transactions took place in his practice: Date Details 1 Opened his bank account with a loan of R250 000. Paid rental for his new office of R5700 (Including VAT) 1 1 Transaction Number 1 23 3 4 45 5 6 789 2 4 11 15 21 30 Purchased office furniture, equipment and computers for R79 800 (including VAT) on credit from Game Stores Purchased office stationery and paid by cheque R 1 710 (including VAT) Performed legal services for a client on credit for R11 400 (including VAT) Performed legal services for a client and billed him an invoice of R 45 600 (including VAT) and received cash The owner purchased fuel for his private car and paid by cheque R 800 Paid for insurance on his business of R 5 700 (including VAT) by cheque Received cash from debtor for the amount charged for fees on the 4th of March. Note: VAT should be calculated at 14%, where applicable. You are required to: 1. Write up the General Journals to account for the above transactions. 2. Write up and balance the General Ledger accounts for the Bank account and the VAT control accounts only.

Step by Step Solution

★★★★★

3.41 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

1 General Journals Date March 1 2012 Transaction Number 1 Description Opened bank account with a loan of R250000 Debit Bank Account R250000 Credit Loa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started