Question

Mr. O's employer requires him to use his own vehicle for work and pay all of the vehicle's operating costs. Mr. O. is not

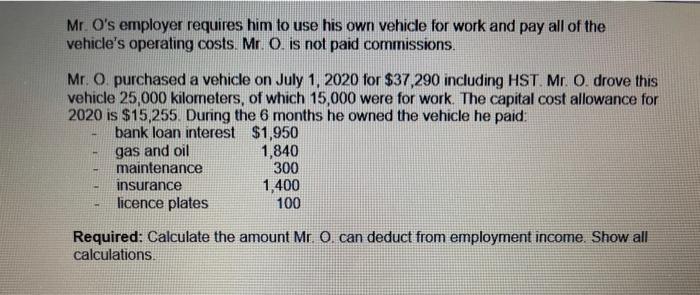

Mr. O's employer requires him to use his own vehicle for work and pay all of the vehicle's operating costs. Mr. O. is not paid commissions. Mr. O. purchased a vehicle on July 1, 2020 for $37,290 including HST. Mr. O. drove this vehicle 25,000 kilometers, of which 15,000 were for work. The capital cost allowance for 2020 is $15,255. During the 6 months he owned the vehicle he paid bank loan interest $1,950 gas and oil maintenance insurance licence plates 1,840 300 1,400 100 Required: Calculate the amount Mr. O. can deduct from employment income. Show all calculations.

Step by Step Solution

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Solution Given data Purchased vehicle on July 202037290 Vehicle driven 25000km In whic...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: Earl K. Stice, James D. Stice

18th edition

538479736, 978-1111534783, 1111534780, 978-0538479738

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App