Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mr. Philip Kotler is selling his firm, Sonic Master Supplies Inc. to Mr. Lawrence Gitman. Mr. Kotlers selling price is at P1,500,000. Mr. Gitman asked

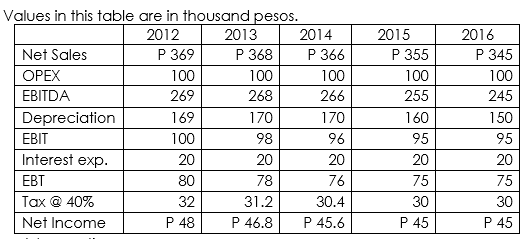

Mr. Philip Kotler is selling his firm, Sonic Master Supplies Inc. to Mr. Lawrence Gitman. Mr. Kotlers selling price is at P1,500,000. Mr. Gitman asked you to help him compute for the fair market value of Sonic Master Supplies Inc. the data are given below:

- Sonic Master Supplies Inc., will invest P30,000 every year from 2012 to 2016.

- Weighted Average Cost of Capital is at 10%

- Free cash flow will grow at 2% every year after the horizon year.

- Terminal year is year 2016.

- What are the free cash flows for 2012 to 2016?

- What is the Fair Market Value of the Firm?

2 decimals.

Values in this table are in thousand pesos. 2012 2013 Net Sales P 369 P 368 OPEX 100 100 EBITDA 269 268 Depreciation 169 170 EBIT 100 98 Interest exp. 20 20 EBT 80 78 Tax @ 40% 32 31.2 Net Income P 48 P 46.8 2014 P 366 100 266 170 96 20 76 30.4 P 45.6 2015 P 355 100 255 160 95 20 75 30 P 45 2016 P 345 100 245 150 95 20 75 30 P 45Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started