Question

Mr. Ponciano Palito died leaving a hereditary property, after estate tax, amounting to P1,200,000. In his last will and testament, he stated that his

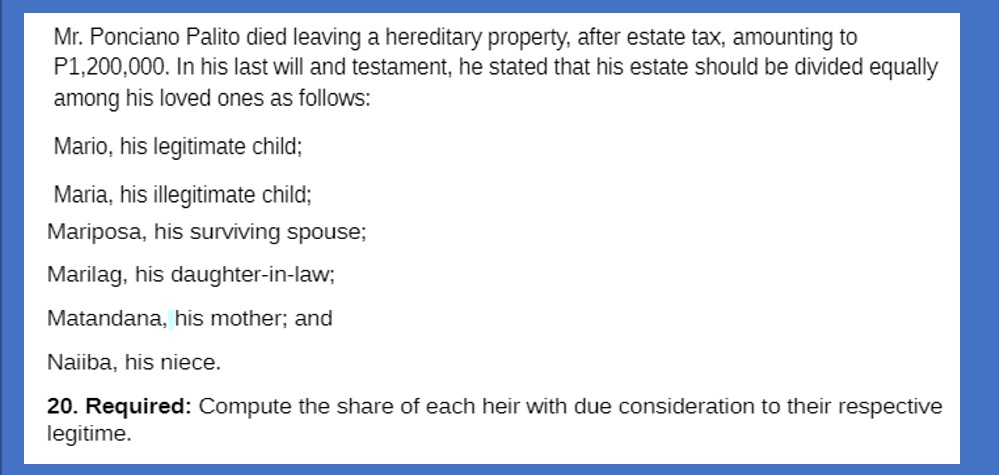

Mr. Ponciano Palito died leaving a hereditary property, after estate tax, amounting to P1,200,000. In his last will and testament, he stated that his estate should be divided equally among his loved ones as follows: Mario, his legitimate child; Maria, his illegitimate child; Mariposa, his surviving spouse; Marilag, his daughter-in-law; Matandana, his mother; and Naiiba, his niece. 20. Required: Compute the share of each heir with due consideration to their respective legitime.

Step by Step Solution

3.49 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

To compute the share of each heir with consideration to their legitime we need to first determine th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Business Law and the Legal Environment

Authors: Jeffrey F. Beatty, Susan S. Samuelson, Patricia Sanchez Abril

8th edition

1337404667, 1337404662, 9781337404532, 1337404535, 978-1337736954

Students also viewed these Law questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App