Answered step by step

Verified Expert Solution

Question

1 Approved Answer

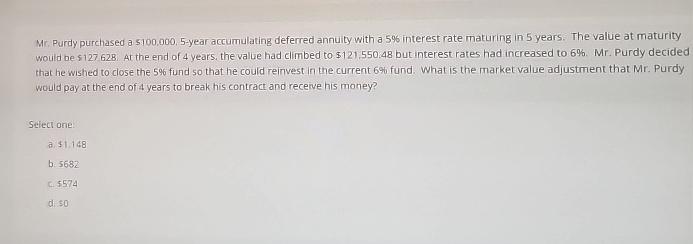

Mr . Purdy purchased a 5 1 0 0 , 0 0 0 , 5 - year accumulating deferred annuity with a 5 % interest

Mr Purdy purchased a year accumulating deferred annuity with a interest rate maturing in years. The value at maturity would be At the end of years, the value had climbed to $ but interest rates had increased to Mr Purdy decided that he wished to close the fund so that he could reinvest in the current fund. What is the market value adjustment that Mr Purdy would pay at the end of years to break his contract and receive his money?

Seleci one.

b

c

diso:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started