Answered step by step

Verified Expert Solution

Question

1 Approved Answer

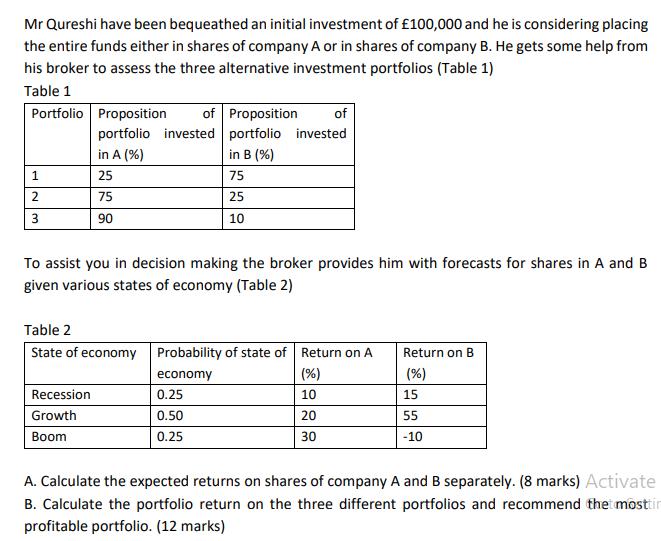

Mr Qureshi have been bequeathed an initial investment of 100,000 and he is considering placing the entire funds either in shares of company A

Mr Qureshi have been bequeathed an initial investment of 100,000 and he is considering placing the entire funds either in shares of company A or in shares of company B. He gets some help from his broker to assess the three alternative investment portfolios (Table 1) Table 1 Portfolio 1 2 3 Proposition of Proposition portfolio invested in A (%) 25 75 90 To assist you in decision making the broker provides him with forecasts for shares in A and B given various states of economy (Table 2) Recession Growth Boom of portfolio invested in B (%) 75 25 10 Table 2 State of economy Probability of state of Return on A economy (%) 10 20 30 0.25 0.50 0.25 Return on B (%) 15 55 -10 A. Calculate the expected returns on shares of company A and B separately. (8 marks) Activate B. Calculate the portfolio return on the three different portfolios and recommend the mosttin profitable portfolio. (12 marks)

Step by Step Solution

★★★★★

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Step 12 Answer Calculating the expected return of Company A and B separat...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started