Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mr Rahim Purchased Grameenphone shares three years ago at BDT 261 per share. During the holding period, Grameen phone has paid dividends as follows:

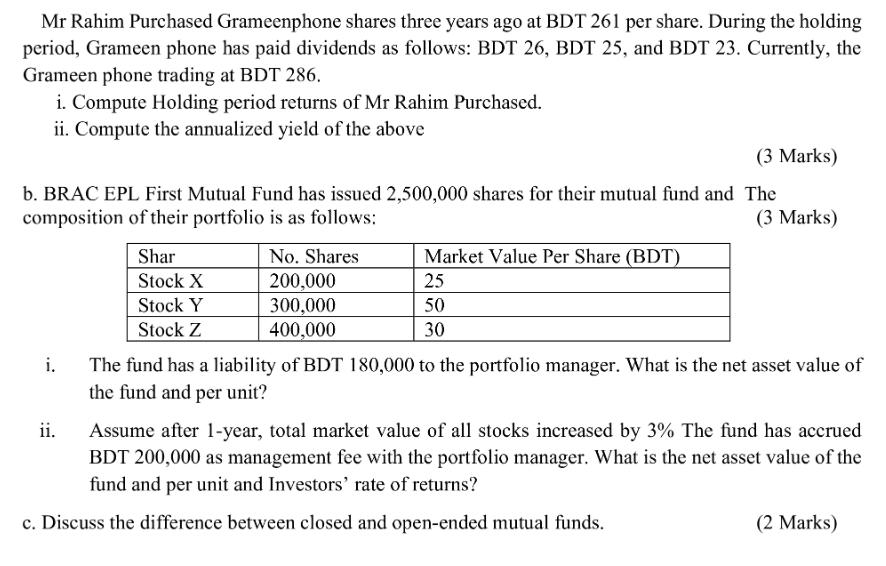

Mr Rahim Purchased Grameenphone shares three years ago at BDT 261 per share. During the holding period, Grameen phone has paid dividends as follows: BDT 26, BDT 25, and BDT 23. Currently, the Grameen phone trading at BDT 286. i. Compute Holding period returns of Mr Rahim Purchased. ii. Compute the annualized yield of the above (3 Marks) (3 Marks) b. BRAC EPL First Mutual Fund has issued 2,500,000 shares for their mutual fund and The composition of their portfolio is as follows: Shar No. Shares Market Value Per Share (BDT) Stock X 200,000 25 Stock Y 300,000 50 Stock Z 400,000 30 i. ii. The fund has a liability of BDT 180,000 to the portfolio manager. What is the net asset value of the fund and per unit? Assume after 1-year, total market value of all stocks increased by 3% The fund has accrued BDT 200,000 as management fee with the portfolio manager. What is the net asset value of the fund and per unit and Investors' rate of returns? c. Discuss the difference between closed and open-ended mutual funds. (2 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started