Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mr Ramu is a chief operating office of the company and being paid a salary of RM15,625 per month. His percentage portion for Employees

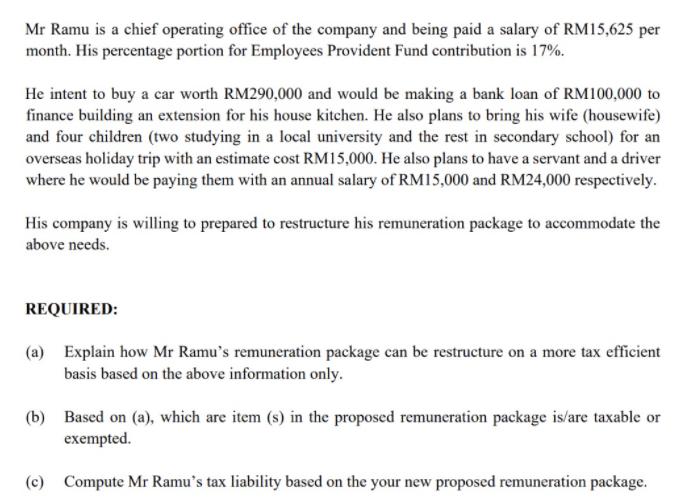

Mr Ramu is a chief operating office of the company and being paid a salary of RM15,625 per month. His percentage portion for Employees Provident Fund contribution is 17%. He intent to buy a car worth RM290,000 and would be making a bank loan of RM100,000 to finance building an extension for his house kitchen. He also plans to bring his wife (housewife) and four children (two studying in a local university and the rest in secondary school) for an overseas holiday trip with an estimate cost RM15,000. He also plans to have a servant and a driver where he would be paying them with an annual salary of RM15,000 and RM24,000 respectively. His company is willing to prepared to restructure his remuneration package to accommodate the above needs. REQUIRED: (a) Explain how Mr Ramu's remuneration package can be restructure on a more tax efficient basis based on the above information only. (b) Based on (a), which are item (s) in the proposed remuneration package is/are taxable or exempted. (c) Compute Mr Ramu's tax liability based on the your new proposed remuneration package.

Step by Step Solution

★★★★★

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Step1 a Remuneration package is provided to the employees for their work in the organization it incl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started