Mr Roth applies for a medium-term loan (5 years) of $4 000 000 to purchase specialised machinery which would expand the production capacity of his

Mr Roth applies for a medium-term loan (5 years) of $4 000 000 to purchase specialised machinery which would expand the production capacity of his business substantially and $3 000 000 additional overdraft facilities to augment the working capital requirements as a result of the expansion.

The business TTM Projects Pty Ltd specialises in the manufacturing of electrical and electronic components for the automotive industry. Mr Roth (the only shareholder of the company) offers the following collateral to the bank for the requested facilities:

- Unlimited guarantee/suretyship by himself;

- A second mortgage bond over his residential property for $2 000 000. (The realistic market value of the property is $3 250 000 according to a valuation recently done by the bank. The first bond to the value of $2,500,000 in favour of your bank secures the existing debt pertaining to the residential property.);

- A cession of debtors;

- A cession of his loan accounts in TTM Projects Pty Ltd;

- A mortgage over the machinery to be purchased; and

- A mortgage over inventory.

1. What is the collateral value of Mr.Roth's unlimited guarantee/suretyship to the bank? Compare your finding with the options listed below and select the option that will most accurately reflect the position regarding Mr. Roth's unlimited suretyship. (Please note: Two of the listed options are correct.)

a. The value will be equal to the assets reflected on the balance sheet.

b. The value will be equal to the shareholder interest.

c. The value will be equal to the projected value of the earnings.

d. The nominal value will be equal to Mr Roths balance sheet surplus but the information is not provided.

e. The real value is zero.

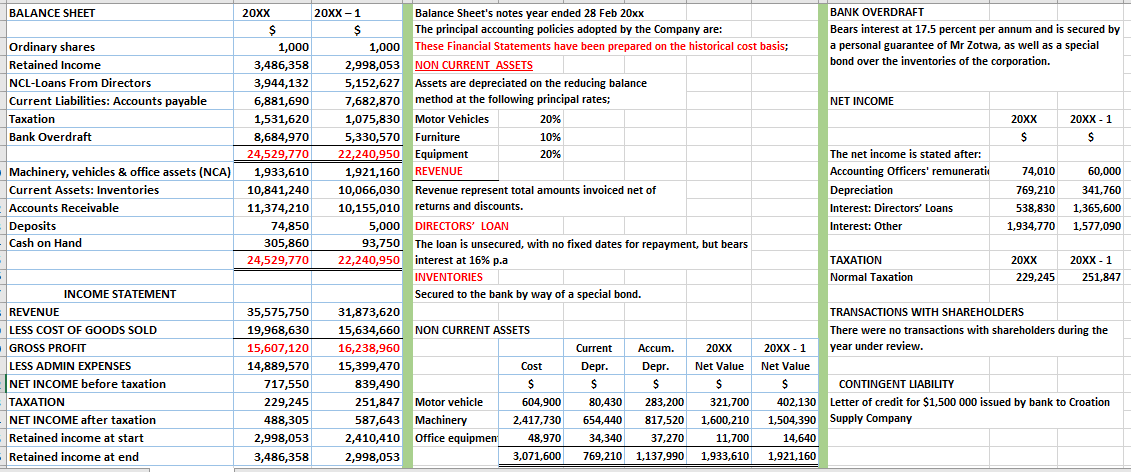

BALANCE SHEET Ordinary shares Retained Income NCL-Loans From Directors Current Liabilities: Accounts payable Taxation Bank Overdraft 20XX $ 1,000 3,486,358 3,944,132 6,881,690 1,531,620 8,684,970 24,529, 770 1,933,610 10,841,240 11,374,210 74,850 305,860 24,529,770 Machinery, vehicles & office assets (NCA) Current Assets: Inventories Accounts Receivable Deposits Cash on Hand 20XX-1 Balance Sheet's notes year ended 28 Feb 20xx BANK OVERDRAFT $ The principal accounting policies adopted by the Company are: Bears interest at 17.5 percent per annum and is secured by 1,000 These Financial Statements have been prepared on the historical cost basis; a personal guarantee of Mr Zotwa, as well as a special 2,998,053 NON CURRENT ASSETS bond over the inventories of the corporation. 5,152,627 Assets are depreciated on the reducing balance 7,682,870 method at the following principal rates; NET INCOME 1,075,830 Motor Vehicles 20% 20XX 20XX - 1 5,330,570 Furniture 10% $ $ 22,240,950 Equipment 20% The net income is stated after: 1,921,160 REVENUE Accounting Officers' remunerati 74,010 60,000 10,066,030 Revenue represent total amounts invoiced net of Depreciation 769,210 341,760 10,155,010 returns and discounts. Interest: Directors' Loans 538,830 1,365,600 5,000 DIRECTORS' LOAN Interest: Other 1,934,770 1,577,090 93,750 The loan is unsecured, with no fixed dates for repayment, but bears 22,240,950 interest at 16% p.a TAXATION 20XX 20XX - 1 INVENTORIES Normal Taxation 229,245 251,847 Secured to the bank by way of a special bond. 31,873,620 TRANSACTIONS WITH SHAREHOLDERS 15,634,660 NON CURRENT ASSETS There were no transactions with shareholders during the 16,238,960 Current Accum. 20XX 20XX - 1 year under review. 15,399,470 Cost Depr. Depr. Net Value Net Value 839,490 $ $ $ $ $ CONTINGENT LIABILITY 251,847 Motor vehicle 604,900 80,430 283,200 321,700 402,130 Letter of credit for $1,500 000 issued by bank to Croation 587,643 Machinery 2,417,730 654,440 817,520 1,600,210 1,504,390 Supply Company 2,410,410 Office equipmen 48,970 34,340 37,270 11,700 14,640 2,998,053 3,071,600 769,210 1,137,990 1,933,610 1,921,160 INCOME STATEMENT REVENUE LESS COST OF GOODS SOLD GROSS PROFIT LESS ADMIN EXPENSES NET INCOME before taxation TAXATION NET INCOME after taxation Retained income at start Retained income at end 35,575,750 19,968,630 15,607,120 14,889,570 717,550 229,245 488,305 2,998,053 3,486,358 BALANCE SHEET Ordinary shares Retained Income NCL-Loans From Directors Current Liabilities: Accounts payable Taxation Bank Overdraft 20XX $ 1,000 3,486,358 3,944,132 6,881,690 1,531,620 8,684,970 24,529, 770 1,933,610 10,841,240 11,374,210 74,850 305,860 24,529,770 Machinery, vehicles & office assets (NCA) Current Assets: Inventories Accounts Receivable Deposits Cash on Hand 20XX-1 Balance Sheet's notes year ended 28 Feb 20xx BANK OVERDRAFT $ The principal accounting policies adopted by the Company are: Bears interest at 17.5 percent per annum and is secured by 1,000 These Financial Statements have been prepared on the historical cost basis; a personal guarantee of Mr Zotwa, as well as a special 2,998,053 NON CURRENT ASSETS bond over the inventories of the corporation. 5,152,627 Assets are depreciated on the reducing balance 7,682,870 method at the following principal rates; NET INCOME 1,075,830 Motor Vehicles 20% 20XX 20XX - 1 5,330,570 Furniture 10% $ $ 22,240,950 Equipment 20% The net income is stated after: 1,921,160 REVENUE Accounting Officers' remunerati 74,010 60,000 10,066,030 Revenue represent total amounts invoiced net of Depreciation 769,210 341,760 10,155,010 returns and discounts. Interest: Directors' Loans 538,830 1,365,600 5,000 DIRECTORS' LOAN Interest: Other 1,934,770 1,577,090 93,750 The loan is unsecured, with no fixed dates for repayment, but bears 22,240,950 interest at 16% p.a TAXATION 20XX 20XX - 1 INVENTORIES Normal Taxation 229,245 251,847 Secured to the bank by way of a special bond. 31,873,620 TRANSACTIONS WITH SHAREHOLDERS 15,634,660 NON CURRENT ASSETS There were no transactions with shareholders during the 16,238,960 Current Accum. 20XX 20XX - 1 year under review. 15,399,470 Cost Depr. Depr. Net Value Net Value 839,490 $ $ $ $ $ CONTINGENT LIABILITY 251,847 Motor vehicle 604,900 80,430 283,200 321,700 402,130 Letter of credit for $1,500 000 issued by bank to Croation 587,643 Machinery 2,417,730 654,440 817,520 1,600,210 1,504,390 Supply Company 2,410,410 Office equipmen 48,970 34,340 37,270 11,700 14,640 2,998,053 3,071,600 769,210 1,137,990 1,933,610 1,921,160 INCOME STATEMENT REVENUE LESS COST OF GOODS SOLD GROSS PROFIT LESS ADMIN EXPENSES NET INCOME before taxation TAXATION NET INCOME after taxation Retained income at start Retained income at end 35,575,750 19,968,630 15,607,120 14,889,570 717,550 229,245 488,305 2,998,053 3,486,358Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started