Answered step by step

Verified Expert Solution

Question

1 Approved Answer

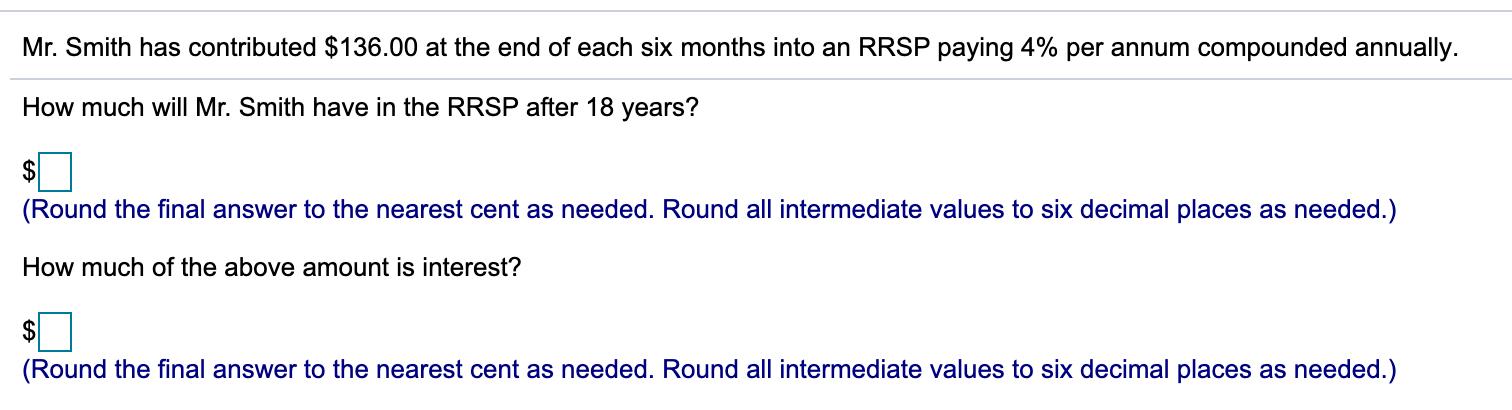

Mr. Smith has contributed $136.00 at the end of each six months into an RRSP paying 4% per annum compounded annually. How much will

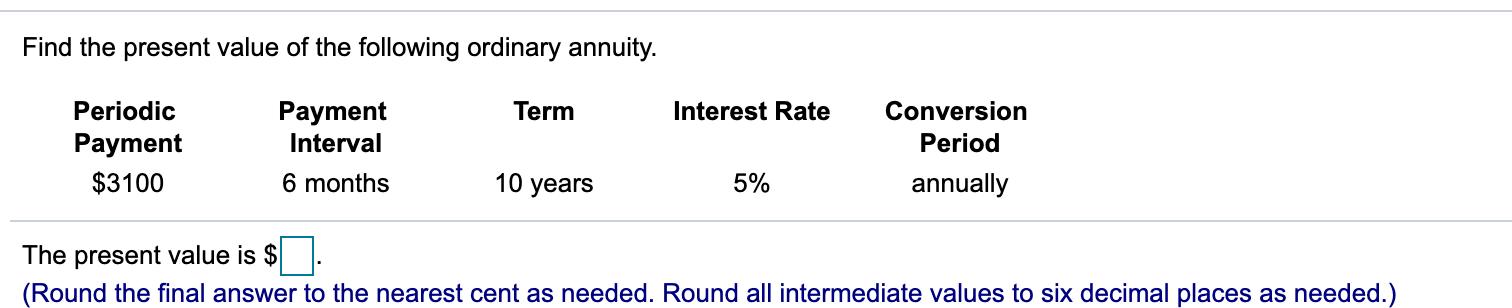

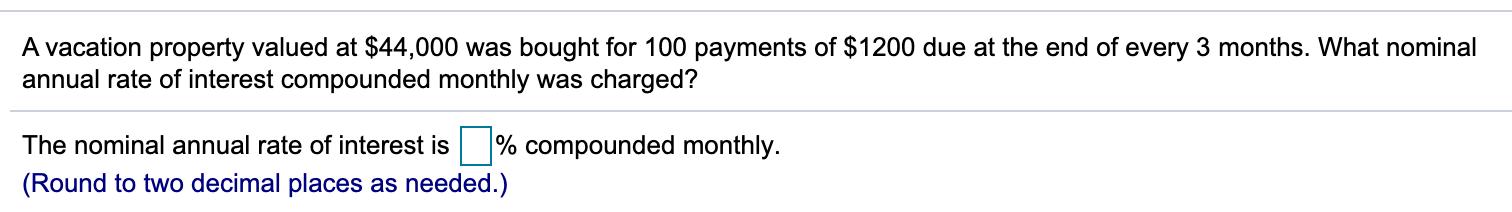

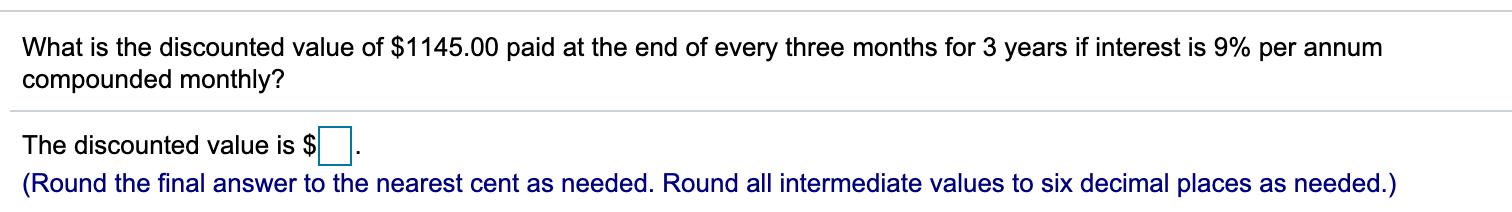

Mr. Smith has contributed $136.00 at the end of each six months into an RRSP paying 4% per annum compounded annually. How much will Mr. Smith have in the RRSP after 18 years? $ (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.) How much of the above amount is interest? $ (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.) Find the present value of the following ordinary annuity. Payment Interval 6 months Periodic Payment $3100 Term 10 years Interest Rate 5% Conversion Period annually The present value is $ (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.) A vacation property valued at $44,000 was bought for 100 payments of $1200 due at the end of every 3 months. What nominal annual rate of interest compounded monthly was charged? The nominal annual rate of interest is % compounded monthly. (Round to two decimal places as needed.) What is the discounted value of $1145.00 paid at the end of every three months for 3 years if interest is 9% per annum compounded monthly? The discounted value is $ (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.)

Step by Step Solution

★★★★★

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the amount Mr Smith will have in the RRSP after 18 years we can use the formula for t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started