Answered step by step

Verified Expert Solution

Question

1 Approved Answer

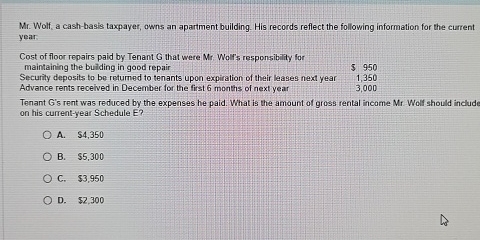

Mr . Wolf, a cash - basis taxpayer, owns an apartment building. His records reflect the following information for the current year: Cost of floor

Mr Wolf, a cashbasis taxpayer, owns an apartment building. His records reflect the following information for the current

year:

Cost of floor repairs paid by Tenant G that were Mr Wolf's responsibitity for

maintaining the building in good repair

Security deposits to be returned to tenants upon expiration of their leases next year

Advance rents recelved in December for the first months of next year

Tenant Gs rent was reduced by the expenses he paid. What is the amount of gross rental income Mr Wolf should include

on his currentyear Schedule E

A

B $

C $

D $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started