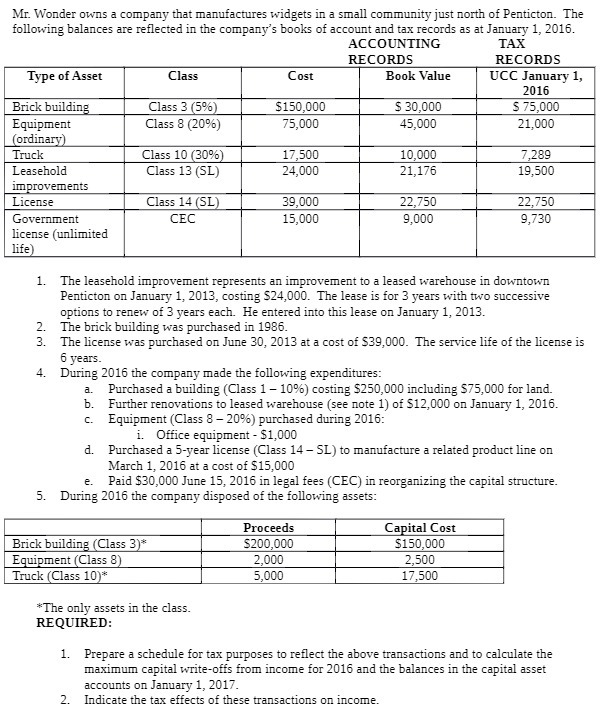

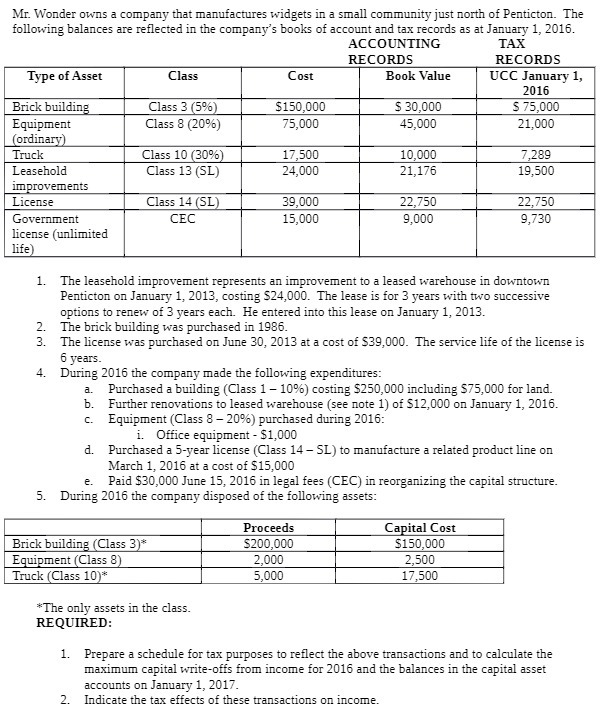

Mr. Wonder owns a company that manufactures widgets in a small community just north of Penticton. The following balances are reflected in the company's books of account and tax records as at January 1, 2016. ACCOUNTING TAX RECORDS RECORDS Type of Asset Class Cost Book Value UCC January 1, 2016 Brick building Class 3 (5%) $150,000 $ 30,000 S 75,000 Equipment Class 8 (20%) 75,000 45,000 21,000 (ordinary) Truck Class 10 (30%) 17,500 10,000 7,289 Leasehold Class 13 (SL) 24,000 21,176 19,500 improvements License Class 14 (SL) 39,000 22,750 22,750 Government CEC 15,000 9,000 9,730 license (unlimited life) 1. The leasehold improvement represents an improvement to a leased warehouse in downtown Penticton on January 1, 2013, costing $24,000. The lease is for 3 years with two successive options to renew of 3 years each. He entered into this lease on January 1, 2013. 2. The brick building was purchased in 1986. 3. The license was purchased on June 30, 2013 at a cost of 539,000. The service life of the license is 6 years. 4. During 2016 the company made the following expenditures: a. Purchased a building (Class 1 - 10%) costing $250,000 including S75,000 for land. b. Further renovations to leased warehouse (see note 1) of $12,000 on January 1, 2016. c. Equipment (Class 8 - 20%) purchased during 2016: i. Office equipment - $1,000 d. Purchased a 5-year license (Class 14 - SL) to manufacture a related product line on March 1, 2016 at a cost of $15,000 Paid $30,000 June 15, 2016 in legal fees (CEC) in reorganizing the capital structure. 5. During 2016 the company disposed of the following assets: e. Brick building (Class 3)* Equipment (Class 8) Truck (Class 10)* Proceeds $200,000 2,000 5,000 Capital Cost $150,000 2,500 17,500 *The only assets in the class. REQUIRED: 1. Prepare a schedule for tax purposes to reflect the above transactions and to calculate the maximum capital write-offs from income for 2016 and the balances in the capital asset accounts on January 1, 2017 2. Indicate the tax effects of these transactions on income. Mr. Wonder owns a company that manufactures widgets in a small community just north of Penticton. The following balances are reflected in the company's books of account and tax records as at January 1, 2016. ACCOUNTING TAX RECORDS RECORDS Type of Asset Class Cost Book Value UCC January 1, 2016 Brick building Class 3 (5%) $150,000 $ 30,000 S 75,000 Equipment Class 8 (20%) 75,000 45,000 21,000 (ordinary) Truck Class 10 (30%) 17,500 10,000 7,289 Leasehold Class 13 (SL) 24,000 21,176 19,500 improvements License Class 14 (SL) 39,000 22,750 22,750 Government CEC 15,000 9,000 9,730 license (unlimited life) 1. The leasehold improvement represents an improvement to a leased warehouse in downtown Penticton on January 1, 2013, costing $24,000. The lease is for 3 years with two successive options to renew of 3 years each. He entered into this lease on January 1, 2013. 2. The brick building was purchased in 1986. 3. The license was purchased on June 30, 2013 at a cost of 539,000. The service life of the license is 6 years. 4. During 2016 the company made the following expenditures: a. Purchased a building (Class 1 - 10%) costing $250,000 including S75,000 for land. b. Further renovations to leased warehouse (see note 1) of $12,000 on January 1, 2016. c. Equipment (Class 8 - 20%) purchased during 2016: i. Office equipment - $1,000 d. Purchased a 5-year license (Class 14 - SL) to manufacture a related product line on March 1, 2016 at a cost of $15,000 Paid $30,000 June 15, 2016 in legal fees (CEC) in reorganizing the capital structure. 5. During 2016 the company disposed of the following assets: e. Brick building (Class 3)* Equipment (Class 8) Truck (Class 10)* Proceeds $200,000 2,000 5,000 Capital Cost $150,000 2,500 17,500 *The only assets in the class. REQUIRED: 1. Prepare a schedule for tax purposes to reflect the above transactions and to calculate the maximum capital write-offs from income for 2016 and the balances in the capital asset accounts on January 1, 2017 2. Indicate the tax effects of these transactions on income