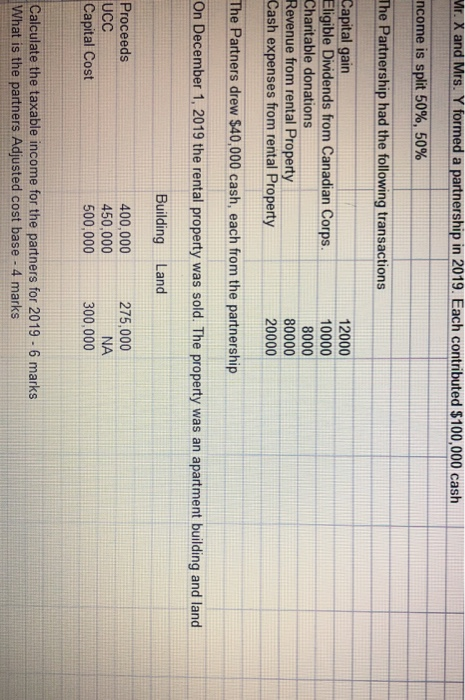

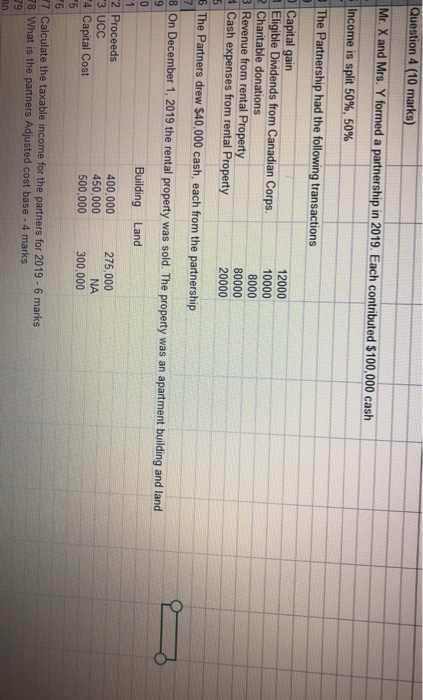

Mr. X and Mrs. Y formed a partnership in 2019. Each contributed $100,000 cash ncome is split 50%, 50% The Partnership had the following transactions Capital gain Eligible Dividends from Canadian Corps. Charitable donations Revenue from rental Property Cash expenses from rental Property 12000 10000 8000 80000 20000 The Partners drew $40,000 cash, each from the partnership On December 1, 2019 the rental property was sold. The property was an apartment building and land Building Land Proceeds UCC 400,000 450,000 500,000 275,000 NA 300,000 Capital Cost Calculate the taxable income for the partners for 2019 - 6 marks What is the partners Adjusted cost base - 4 marks Question 4 (10 marks) Mr. X and Mrs. Y formed a partnership in 2019. Each contributed $100,000 cash Income is split 50%, 50% The Partnership had the following transactions Capital gain Eligible Dividends from Canadian Corps. 2 Charitable donations 3. Revenue from rental Property 4 Cash expenses from rental Property 12000 10000 8000 80000 20000 6 The Partners drew $40,000 cash, each from the partnership 8 On December 1, 2019 the rental property was sold. The property was an apartment building and land Building Land 2 Proceeds 3 UCC -4 Capital Cost 400,000 450.000 500.000 275,000 NA 300,000 27 Calculate the taxable income for the partners for 2019 - 6 marks 78 What is the partners Adjusted cost base - 4 marks Mr. X and Mrs. Y formed a partnership in 2019. Each contributed $100,000 cash ncome is split 50%, 50% The Partnership had the following transactions Capital gain Eligible Dividends from Canadian Corps. Charitable donations Revenue from rental Property Cash expenses from rental Property 12000 10000 8000 80000 20000 The Partners drew $40,000 cash, each from the partnership On December 1, 2019 the rental property was sold. The property was an apartment building and land Building Land Proceeds UCC 400,000 450,000 500,000 275,000 NA 300,000 Capital Cost Calculate the taxable income for the partners for 2019 - 6 marks What is the partners Adjusted cost base - 4 marks Question 4 (10 marks) Mr. X and Mrs. Y formed a partnership in 2019. Each contributed $100,000 cash Income is split 50%, 50% The Partnership had the following transactions Capital gain Eligible Dividends from Canadian Corps. 2 Charitable donations 3. Revenue from rental Property 4 Cash expenses from rental Property 12000 10000 8000 80000 20000 6 The Partners drew $40,000 cash, each from the partnership 8 On December 1, 2019 the rental property was sold. The property was an apartment building and land Building Land 2 Proceeds 3 UCC -4 Capital Cost 400,000 450.000 500.000 275,000 NA 300,000 27 Calculate the taxable income for the partners for 2019 - 6 marks 78 What is the partners Adjusted cost base - 4 marks