Question

Mr. Xof XYZ and Partners would like your help to value INFY, a company that is publically listed in the Indian stock exchanges. The valuation

Mr. Xof XYZ and Partners would like your help to value INFY, a company that is publically listed in the Indian stock exchanges. The valuation methodology to be used is to advise Mr Xon whether INFY is a good buy or not. XYZ and Co, would like to invest in both the equity shares as well as bonds of INFY. Based on the below information, and the valuation methodology subscribed, advise if INFY is a good stock

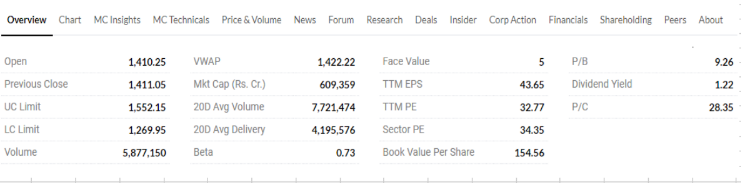

1 INFY pays an annual dividend of 300/- per stock. It is expected that INFY dividends will rise by 10% for the next year. 2 The current RBI rate in India is 6%, index has performed at an average of 8%, 10% and 12% over the last three years. Infy is looking at a growth rate of 2% till eternity. 3 INFY bonds in the market are currently having a coupon rate of 7% with a YTM of 9%. 4 The tax rate in the country is currently 20% for corporate and 10% for individuals. 5 INFY has a beta of 0.73 with the index and this is based on historical variance covariance and correlation calculations. 6 INFY expects a profit of 20,000 cr in the future (next 10 years) and it is expected to grow at 5% per year from 2021 till 2030. 7 See below for INFY share price, P/E, etc as well as industry numbers -

8 Avg dividend yield in the market for companies from the same sector is 2. 9 INFY bonds are also available in the market currently at 300/ bond. Each bond is denominated in 100s. 10 Based on the above, answer the following - 1 What is the intrinsic value per share based on DDM. 2 What is the intrinsic value per share based on DCF. 3 Based on Dividend Yield, is the share overbought or oversold? 4 What is the intrinsic value of a bond based on YTM? 5 Will INFY bonds be trading at a low bid-ask spread or a high-bid ask spread, why? 6 Based on your analysis, are INFY shares and bonds good buys?

Overview Chart MC Insights MCTechnicals Price E Volume News Forum Research Deals Insider Corp Action Financials Shareholding Peers AboutStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started