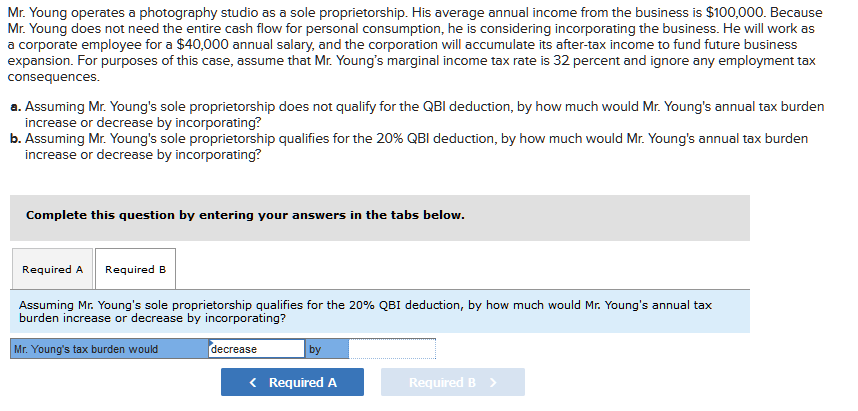

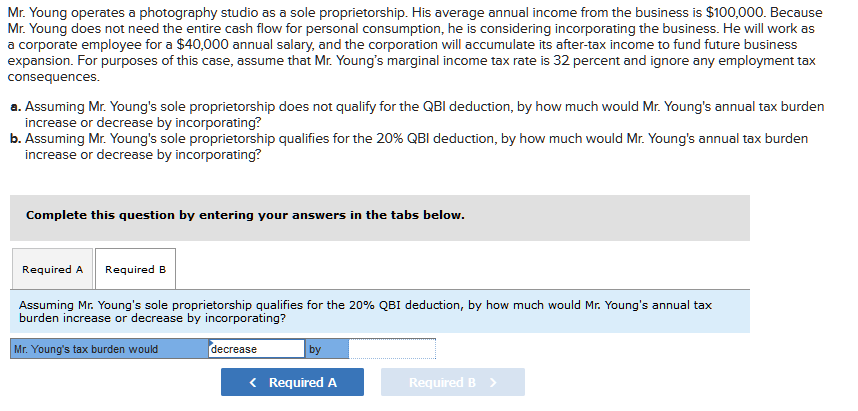

Mr. Young operates a photography studio as a sole proprietorship. His average annual income from the business is $100,000. Because Mr. Young does not need the entire cash flow for personal consumption, he is considering incorporating the business. He will work as a corporate employee for a $40,000 annual salary, and the corporation will accumulate its after-tax income to fund future business expansion. For purposes of this case, assume that Mr. Young's marginal income tax rate is 32 percent and ignore any employment tax consequences a. Assuming Mr. Young's sole proprietorship does not qualify for the QBl deduction, by how much would Mr. Young's annual tax burden increase or decrease by incorporating? b. Assuming Mr. Young's sole proprietorship qualifies for the 20% QBl deduction, by how much would Mr. Young's annual tax burden increase or decrease by incorporating? Complete this question by entering your answers in the tabs below. Required A Required B Assuming Mr. Young's sole proprietorship qualifies for the 20% QBI deduction, by how much would Mr. Young's annual tax burden increase or decrease by incorporating? decrease Mr. Young's tax burden would by Required A Required B Mr. Young operates a photography studio as a sole proprietorship. His average annual income from the business is $100,000. Because Mr. Young does not need the entire cash flow for personal consumption, he is considering incorporating the business. He will work as a corporate employee for a $40,000 annual salary, and the corporation will accumulate its after-tax income to fund future business expansion. For purposes of this case, assume that Mr. Young's marginal income tax rate is 32 percent and ignore any employment tax consequences a. Assuming Mr. Young's sole proprietorship does not qualify for the QBl deduction, by how much would Mr. Young's annual tax burden increase or decrease by incorporating? b. Assuming Mr. Young's sole proprietorship qualifies for the 20% QBl deduction, by how much would Mr. Young's annual tax burden increase or decrease by incorporating? Complete this question by entering your answers in the tabs below. Required A Required B Assuming Mr. Young's sole proprietorship qualifies for the 20% QBI deduction, by how much would Mr. Young's annual tax burden increase or decrease by incorporating? decrease Mr. Young's tax burden would by Required A Required B