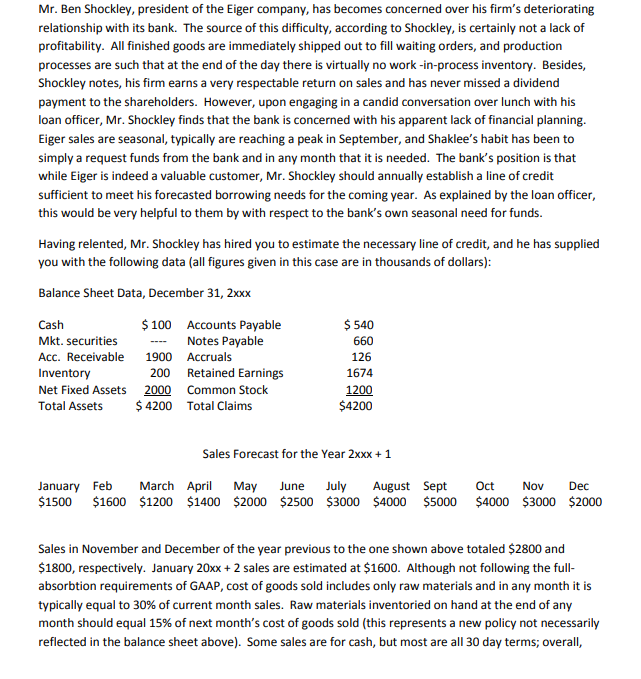

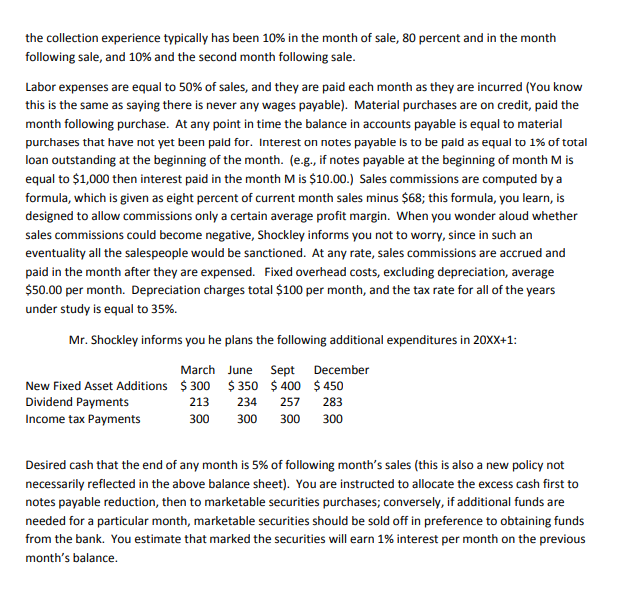

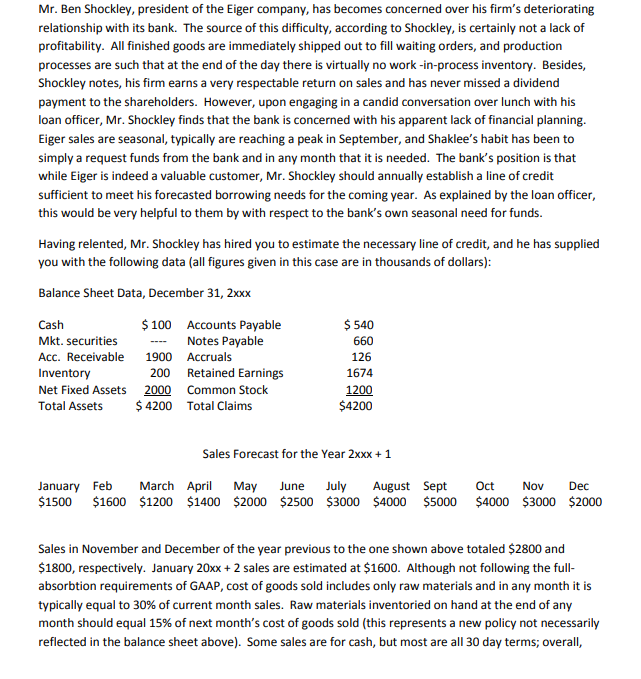

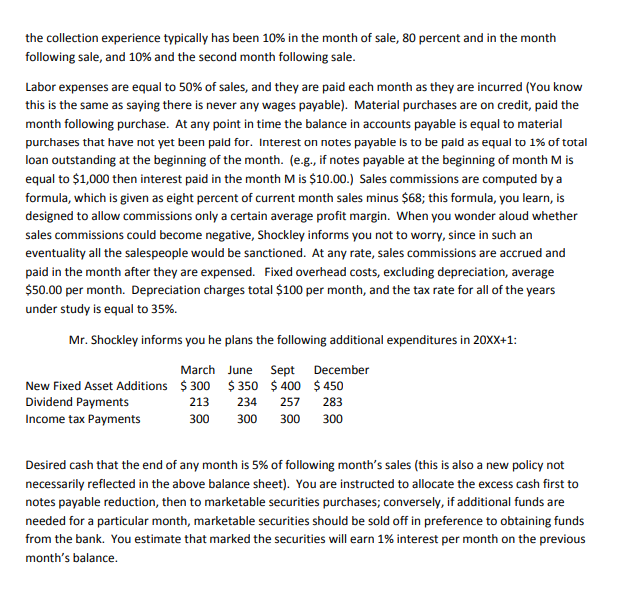

Mr.Ben Shockley, president of the Eiger company, has becomes concerned over his firm's deteriorating relationship with its bank. The source of this difficulty, according to Shockley, is certainly not a lack of profitability. All finished goods are immediately shipped out to fill waiting orders, and production processes are such that at the end of the day there is virtually no work-in-process inventory. Besides, Shockley notes, his firm earns a very respectable return on sales and has never missed a dividend payment to the shareholders. However, upon engaging in a candid conversation over lunch with his loan officer, Mr. Shockley finds that the bank is concerned with his apparent lack of financial planning. Eiger sales are seasonal, typically are reaching a peak in September, and Shaklee's habit has been to simply a request funds from the bank and in any month that it is needed. The bank's position is that while Eiger is indeed a valuable customer, Mr. Shockley should annually establish a line of credit sufficient to meet his forecasted borrowing needs for the coming year. As explained by the loan officer, this would be very helpful to them by with respect to the bank's own seasonal need for funds. Having relented, Mr. Shockley has hired you to estimate the necessary line of credit, and he has supplied you with the following data (all figures given in this case are in thousands of dollars): Balance Sheet Data, December 31, 2xxx $ 100 Accounts Payable $ 540 Mkt. securities Notes Payable 660 Acc. Receivable 1900 Accruals 126 Inventory 200 Retained Earnings 1674 Net Fixed Assets 2000 Common Stock 1200 Total Assets $ 4200 Total Claims $4200 Cash Sales Forecast for the Year 2xxx + 1 January Feb March April May June July August Sept Oct Nov Dec $1500 $1600 $1200 $1400 $2000 $2500 $3000 $4000 $5000 $4000 $3000 $2000 Sales in November and December of the year previous to the one shown above totaled $2800 and $1800, respectively. January 20xx + 2 sales are estimated at $1600. Although not following the full- absorbtion requirements of GAAP, cost of goods sold includes only raw materials and in any month it is typically equal to 30% of current month sales. Raw materials inventoried on hand at the end of any month should equal 15% of next month's cost of goods sold (this represents a new policy not necessarily reflected in the balance sheet above). Some sales are for cash, but most are all 30 day terms; overall, the collection experience typically has been 10% in the month of sale, 80 percent and in the month following sale, and 10% and the second month following sale. Labor expenses are equal to 50% of sales, and they are paid each month as they are incurred (You know this is the same as saying there is never any wages payable). Material purchases are on credit, paid the month following purchase. At any point in time the balance in accounts payable is equal to material purchases that have not yet been paid for. Interest on notes payable is to be paid as equal to 1% of total loan outstanding at the beginning of the month. (e.g., if notes payable at the beginning of month M is equal to $1,000 then interest paid in the month M is $10.00.) Sales commissions are computed by a formula, which is given as eight percent of current month sales minus $68; this formula, you learn, is designed to allow commissions only a certain average profit margin. When you wonder aloud whether sales commissions could become negative, Shockley informs you not to worry, since in such an eventuality all the salespeople would be sanctioned. At any rate, sales commissions are accrued and paid in the month after they are expensed. Fixed overhead costs, excluding depreciation, average $50.00 per month. Depreciation charges total $100 per month, and the tax rate for all of the years under study is equal to 35%. Mr. Shockley informs you he plans the following additional expenditures in 20XX+1: March June Sept December New Fixed Asset Additions $ 300 $ 350 $ 400 $ 450 Dividend Payments 213 234 257 Income tax Payments 300 300 300 300 283 Desired cash that the end of any month is 5% of following month's sales (this is also a new policy not necessarily reflected in the above balance sheet). You are instructed to allocate the excess cash first to notes payable reduction, then to marketable securities purchases; conversely, if additional funds are needed for a particular month, marketable securities should be sold off in preference to obtaining funds from the bank. You estimate that marked the securities will earn 1% interest per month on the previous month's balance. Mr.Ben Shockley, president of the Eiger company, has becomes concerned over his firm's deteriorating relationship with its bank. The source of this difficulty, according to Shockley, is certainly not a lack of profitability. All finished goods are immediately shipped out to fill waiting orders, and production processes are such that at the end of the day there is virtually no work-in-process inventory. Besides, Shockley notes, his firm earns a very respectable return on sales and has never missed a dividend payment to the shareholders. However, upon engaging in a candid conversation over lunch with his loan officer, Mr. Shockley finds that the bank is concerned with his apparent lack of financial planning. Eiger sales are seasonal, typically are reaching a peak in September, and Shaklee's habit has been to simply a request funds from the bank and in any month that it is needed. The bank's position is that while Eiger is indeed a valuable customer, Mr. Shockley should annually establish a line of credit sufficient to meet his forecasted borrowing needs for the coming year. As explained by the loan officer, this would be very helpful to them by with respect to the bank's own seasonal need for funds. Having relented, Mr. Shockley has hired you to estimate the necessary line of credit, and he has supplied you with the following data (all figures given in this case are in thousands of dollars): Balance Sheet Data, December 31, 2xxx $ 100 Accounts Payable $ 540 Mkt. securities Notes Payable 660 Acc. Receivable 1900 Accruals 126 Inventory 200 Retained Earnings 1674 Net Fixed Assets 2000 Common Stock 1200 Total Assets $ 4200 Total Claims $4200 Cash Sales Forecast for the Year 2xxx + 1 January Feb March April May June July August Sept Oct Nov Dec $1500 $1600 $1200 $1400 $2000 $2500 $3000 $4000 $5000 $4000 $3000 $2000 Sales in November and December of the year previous to the one shown above totaled $2800 and $1800, respectively. January 20xx + 2 sales are estimated at $1600. Although not following the full- absorbtion requirements of GAAP, cost of goods sold includes only raw materials and in any month it is typically equal to 30% of current month sales. Raw materials inventoried on hand at the end of any month should equal 15% of next month's cost of goods sold (this represents a new policy not necessarily reflected in the balance sheet above). Some sales are for cash, but most are all 30 day terms; overall, the collection experience typically has been 10% in the month of sale, 80 percent and in the month following sale, and 10% and the second month following sale. Labor expenses are equal to 50% of sales, and they are paid each month as they are incurred (You know this is the same as saying there is never any wages payable). Material purchases are on credit, paid the month following purchase. At any point in time the balance in accounts payable is equal to material purchases that have not yet been paid for. Interest on notes payable is to be paid as equal to 1% of total loan outstanding at the beginning of the month. (e.g., if notes payable at the beginning of month M is equal to $1,000 then interest paid in the month M is $10.00.) Sales commissions are computed by a formula, which is given as eight percent of current month sales minus $68; this formula, you learn, is designed to allow commissions only a certain average profit margin. When you wonder aloud whether sales commissions could become negative, Shockley informs you not to worry, since in such an eventuality all the salespeople would be sanctioned. At any rate, sales commissions are accrued and paid in the month after they are expensed. Fixed overhead costs, excluding depreciation, average $50.00 per month. Depreciation charges total $100 per month, and the tax rate for all of the years under study is equal to 35%. Mr. Shockley informs you he plans the following additional expenditures in 20XX+1: March June Sept December New Fixed Asset Additions $ 300 $ 350 $ 400 $ 450 Dividend Payments 213 234 257 Income tax Payments 300 300 300 300 283 Desired cash that the end of any month is 5% of following month's sales (this is also a new policy not necessarily reflected in the above balance sheet). You are instructed to allocate the excess cash first to notes payable reduction, then to marketable securities purchases; conversely, if additional funds are needed for a particular month, marketable securities should be sold off in preference to obtaining funds from the bank. You estimate that marked the securities will earn 1% interest per month on the previous month's balance