Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mrs Best seeks to invest R375 000. He approached you and explains that he is considering two possible investments. Option A, being a money

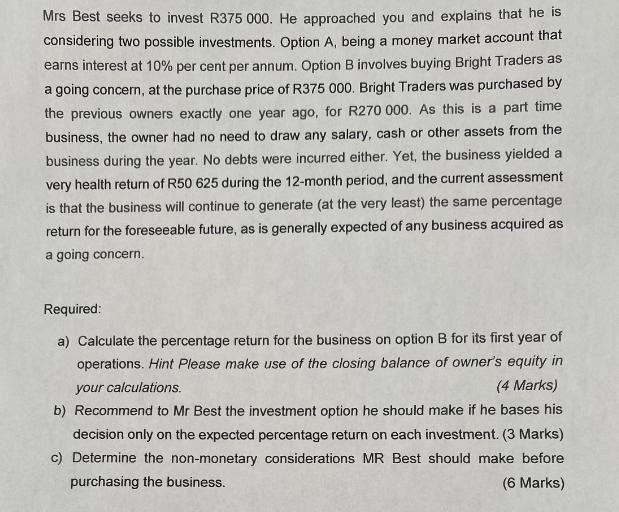

Mrs Best seeks to invest R375 000. He approached you and explains that he is considering two possible investments. Option A, being a money market account that earns interest at 10% per cent per annum. Option B involves buying Bright Traders as a going concern, at the purchase price of R375 000. Bright Traders was purchased by the previous owners exactly one year ago, for R270 000. As this is a part time business, the owner had no need to draw any salary, cash or other assets from the business during the year. No debts were incurred either. Yet, the business yielded a very health return of R50 625 during the 12-month period, and the current assessment is that the business will continue to generate (at the very least) the same percentage return for the foreseeable future, as is generally expected of any business acquired as a going concern. Required: a) Calculate the percentage return for the business on option B for its first year of operations. Hint Please make use of the closing balance of owner's equity in your calculations. (4 Marks) b) Recommend to Mr Best the investment option he should make if he bases his decision only on the expected percentage return on each investment. (3 Marks) c) Determine the non-monetary considerations MR Best should make before purchasing the business. (6 Marks)

Step by Step Solution

★★★★★

3.40 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the percentage return for the business on Option B you can use the formula Percentage ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started