Answered step by step

Verified Expert Solution

Question

1 Approved Answer

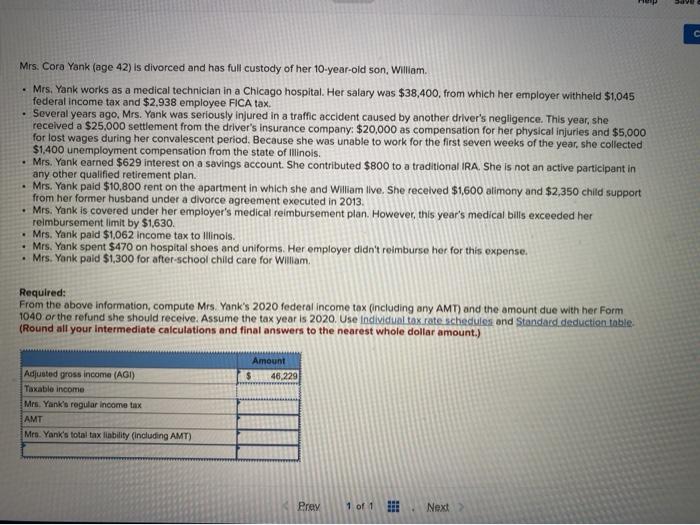

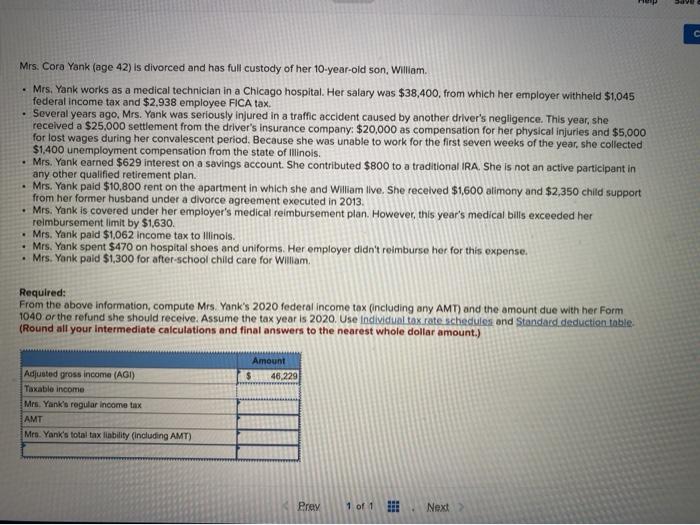

Mrs. Cora Yank (age 42) is divorced and has full custody of her 10 year old son, William C Mrs. Cora Yonk (age 42) is

Mrs. Cora Yank (age 42) is divorced and has full custody of her 10 year old son, William

C Mrs. Cora Yonk (age 42) is divorced and has full custody of her 10-year-old son, William Mrs. Yank works as a medical technician in a Chicago hospital. Her salary was $38,400, from which her employer withheld $1045 federal income tax and $2,938 employee FICA tax. Several years ago, Mrs. Yank was seriously injured in a traffic accident caused by another driver's negligence. This year, she received a $25,000 settlement from the driver's Insurance company: $20,000 as compensation for her physical injuries and $5,000 for lost wages during her convalescent period. Because she was unable to work for the first seven weeks of the year, she collected $1,400 unemployment compensation from the state of Illinois. Mrs. Yank earned $629 interest on a savings account. She contributed $800 to a traditional IRA. She is not an active participant in any other qualified retirement plan. Mrs. Yonk paid $10,800 rent on the apartment in which she and William live. She received $1600 alimony and $2,350 child support from her former husband under a divorce agreement executed in 2013 Mrs. Yonk is covered under her employer's medical reimbursement plan. However, this year's medical bills exceeded her reimbursement limit by $1,630. Mrs. Yank paid $1,062 income tax to Illinois. Mrs. Yonk spent $470 on hospital shoes and uniforms. Her employer didn't reimburse her for this expense. Mrs. Yonk paid $1,300 for after school child care for William Required: From the above information, compute Mrs. Yonk's 2020 federal income tax (including any AMT) and the amount due with her Form 1040 or the refund she should receive. Assume the tax year is 2020. Use Individual tax rate schedules and Standard deduction table (Round all your intermediate calculations and final answers to the nearest whole dollar amount.) Amount $ 46.229 Adjusted gross income (AGI) Taxable income Mes Yank's regular income tax AMT Men Yank's total tax liability (including AMT) Prey 1 of 1 Next

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started