Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mrs. Enghog, a minimum wager earner, works for Rigen, Inc. She is not engaged in business nor has any other source of income other than

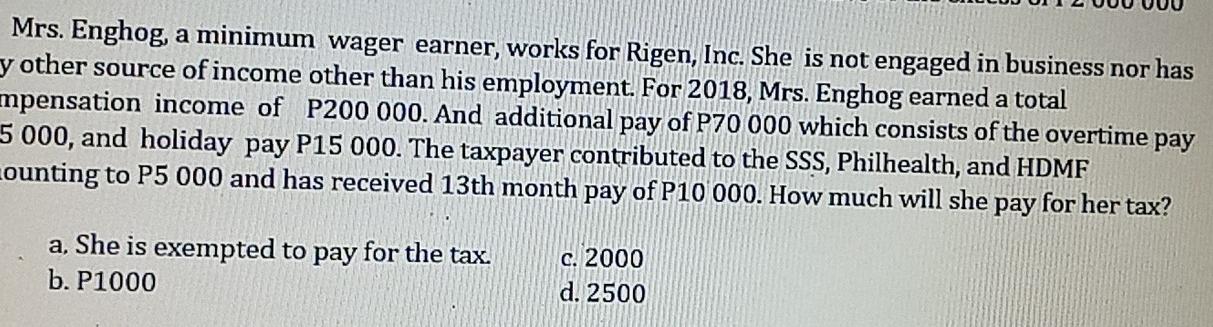

Mrs. Enghog, a minimum wager earner, works for Rigen, Inc. She is not engaged in business nor has any other source of income other than his employment. For 2018, Mrs. Enghog earned a total compensation income of P200,000. And additional pay of P70,000 which consists of the overtime pay P55,000, and holiday pay P15000. The taxpayer contributed to the SSS, Philhealth, and HDMF amounting to P5000 and has recieved 13th month pay of P10,000. How much will she pay for her tax?

Mrs. Enghog, a minimum wager earner, works for Rigen, Inc. She is not engaged in business nor has y other source of income other than his employment. For 2018, Mrs. Enghog earned a total mpensation income of P200 000. And additional pay of P70 000 which consists of the overtime pay 5 000, and holiday pay P15 000. The taxpayer contributed to the SSS, Philhealth, and HDMF counting to P5 000 and has received 13th month pay of P10 000. How much will she pay for her tax? a. She is exempted to pay for the tax. b. P1000 C. 2000 d. 2500 Mrs. Enghog, a minimum wager earner, works for Rigen, Inc. She is not engaged in business nor has y other source of income other than his employment. For 2018, Mrs. Enghog earned a total mpensation income of P200 000. And additional pay of P70 000 which consists of the overtime pay 5 000, and holiday pay P15 000. The taxpayer contributed to the SSS, Philhealth, and HDMF counting to P5 000 and has received 13th month pay of P10 000. How much will she pay for her tax? a. She is exempted to pay for the tax. b. P1000 C. 2000 d. 2500Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started