Question

Mrs. Johnson founded a chemical manufacturing company 25 years ago and built a successful business, which is now in a mature growth stage. She owns

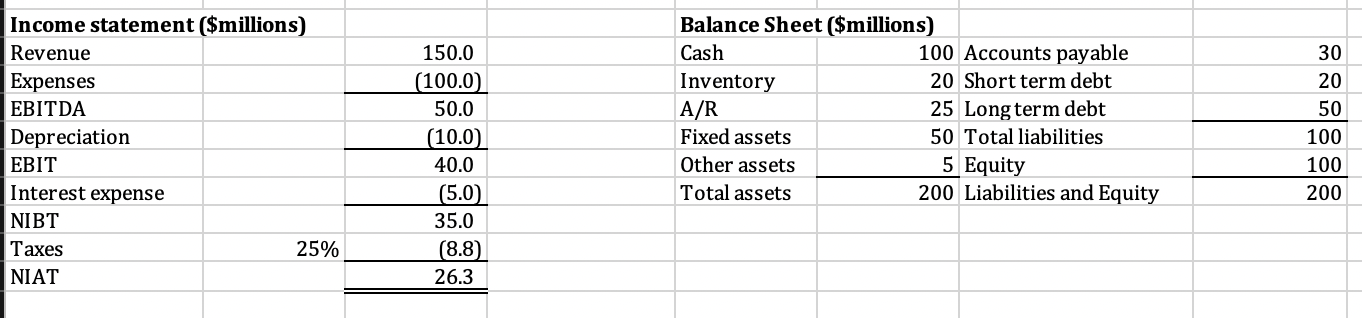

Mrs. Johnson founded a chemical manufacturing company 25 years ago and built a successful business, which is now in a mature growth stage. She owns 100% of the company and is thinking about retiring in a few years. She considers an IPO to cash out (sell some of her shares) and hires you to estimate the market value of his equity. Last year's financial statements are presented below. You also collected the following information:

-the company free cash flow has been growing at 2.5% and no changes are expected;

-CapEx is typically 5% higher than annual depreciation;

-working capital has been growing at 3% annually;

-cost of capital for similar companies is 12.0%

a) Assuming that the book value of debt is approximately equal to the market value of debt, what is the enterprise value?

b) The company will issue 10 million shares; what is the fair value per share?

Consider the following: a private investor approaches Mrs. Johnson and offers to pay $100 million for 25% of the company's equity; given that the private investor has access to all of the information, what is the cost of capital of this private investor?

Income statement ($millions) Revenue Expenses EBITDA Depreciation EBIT Interest expense 150.0 (100.0) 50.0 (10.0) 40.0 (5.0) 35.0 NIBT Taxes NIAT 25% (8.8) 26.3 Balance Sheet (Smillions) Cash Inventory A/R 100 Accounts payable 30 20 Short term debt 20 25 Long term debt 50 Fixed assets 50 Total liabilities 100 Other assets 5 Equity 100 Total assets 200 Liabilities and Equity 200

Step by Step Solution

3.41 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER To solve this problem well follow these steps a Calculate the enterprise value b Calculate th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started