Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mrs. Liz Otieno is a professional dentist who practices in Nairobi. She has provided you with the details on her clinic for the year

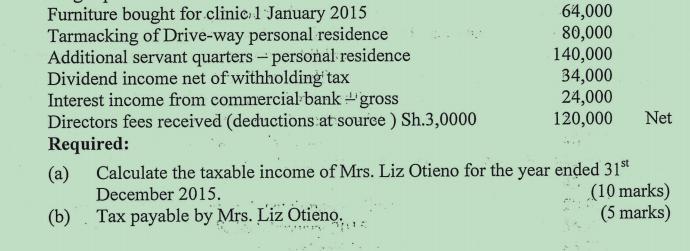

Mrs. Liz Otieno is a professional dentist who practices in Nairobi. She has provided you with the details on her clinic for the year ended 31st December 2015: Sh. Gross Professional fees received Subscriptions to professional association and publications.... Subscriptions to a wildlife magazine 1,000,000 20,000.. 2,000 10,000 Mak 6,000 120,000 Replacement of surgical instruments 40,000 Rent for the clinic premises dentist v tometice in Nairobi, F40,000 Electricity and water - clinic 40,000 70,000 ..:50,000 5,000 40,000 60,000 20,000 50,000 12,000 14,000 Donations to a children's home Debt collection expenses (dental patients) Wages for dental assistant Other clinic expenses Hire of car for use in practiced Uniforms for staff Payment of school fees for own children Contribution to provident fund-self Payment of life insurance premium + self Terminal benefits paid to retired receptionist Depreciation on furniture-clinic Rents received from sub-rentals Rent collection expenses(sub-tenants) Wages paid to cleaners and watchman - clinic t N 7+1 42,000 50,000 TY Furniture bought for clinic, 1 January 2015 Tarmacking of Drive-way personal residence Additional servant quarters - personal residence Dividend income net of withholding tax Interest income from commercial bank +gross Directors fees received (deductions at source ) Sh.3,0000 Required: 64,000 80,000 140,000 34,000 24,000 120,000 Net (a) Calculate the taxable income of Mrs. Liz Otieno for the year ended 31st December 2015. (b) Tax payable by Mrs. Liz Otieno. 112 (10 marks) (5 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below a Calculate the taxable income of Mrs L...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started