Answered step by step

Verified Expert Solution

Question

1 Approved Answer

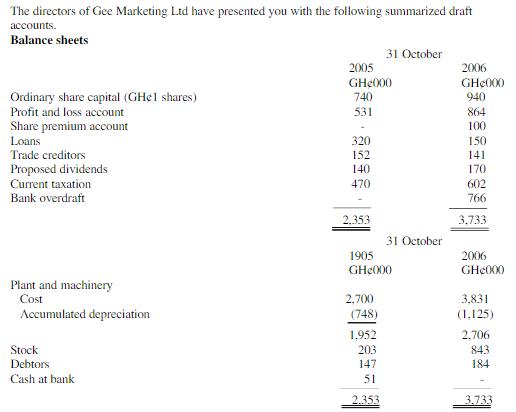

The directors of Gee Marketing Ltd have presented you with the following summarized draft accounts. Balance sheets Ordinary share capital (GH1 shares) Profit and

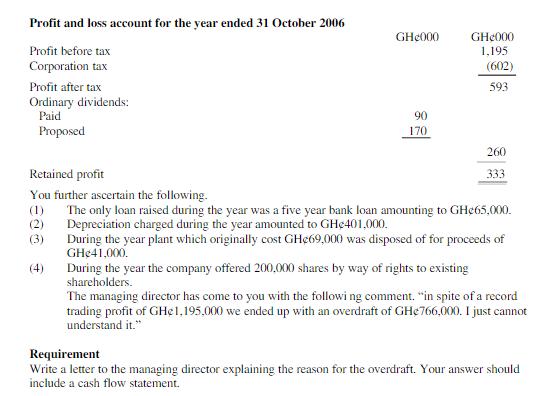

The directors of Gee Marketing Ltd have presented you with the following summarized draft accounts. Balance sheets Ordinary share capital (GH1 shares) Profit and loss account Share premium account Loans Trade creditors Proposed dividends Current taxation Bank overdraft Plant and machinery Cost Accumulated depreciation Stock Debtors Cash at bank 2005 GH000 740 531 320 152 140 470 2,353 31 October 2,700 1905 GH000 (748) 1,952 203 147 51 2.353 31 October 2006 GH000 940 864 100 150 141 170. 602 766 3.733 2006 GH000 3,831 (1,125) 2.706 843 184 3.733 Profit and loss account for the year ended 31 October 2006 Profit before tax Corporation tax Profit after tax Ordinary dividends: Paid Proposed GH000 90 170 GH000 1,195 During the year the company offered 200,000 shares by way of rights to existing shareholders. (602) 593 260 333 Retained profit You further ascertain the following. (1) (2) The only loan raised during the year was a five year bank loan amounting to GH65,000. Depreciation charged during the year amounted to GH 401,000. (3) During the year plant which originally cost GHe69,000 was disposed of for proceeds of GH41,000. The managing director has come to you with the following comment. "in spite of a record trading profit of GHe 1,195,000 we ended up with an overdraft of GH766,000. I just cannot understand it." Requirement Write a letter to the managing director explaining the reason for the overdraft. Your answer should include a cash flow statement.

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Dear managing director I have been asked to explain the cause of the companys overdraft of GHe766000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started