Question

Mrs. Monroe asks her bank for a personal loan to be contracted for a 1-year period at an interest rate of 9.5% two years from

Mrs. Monroe asks her bank for a personal loan to be contracted for a 1-year period at an interest rate of 9.5% two years from now. The bank usually asks for a 1.8% additional charge above the expected interest rate on Treasury bond of similar bonds. Assume that:

1. The required rate by the bank is equal to: *

a. 8.56%

b. 8.80%

c. 10.36%

d. 10.60%

e. None of the above

2. Would the bank accept Mrs. Monroes request? *

a. No, the bank would not accept Mrs. Monroes request, because the banks required rate is less than the customers offered rate

b. Yes, the bank would accept Mrs. Monroes request, because the banks required rate is less than the customers offered rate

c. No, the bank would not accept Mrs. Monroes request, because the banks required rate is higher than the customers offered rate

d. Yes, the bank would accept Mrs. Monroes request, because the banks required rate is higher than the customers offered rate

e. None of the above

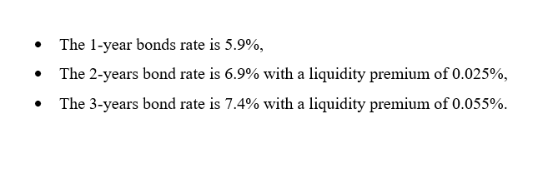

The 1-year bonds rate is 5.9%, The 2-years bond rate is 6.9% with a liquidity premium of 0.025%, The 3-years bond rate is 7.4% with a liquidity premium of 0.055%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started