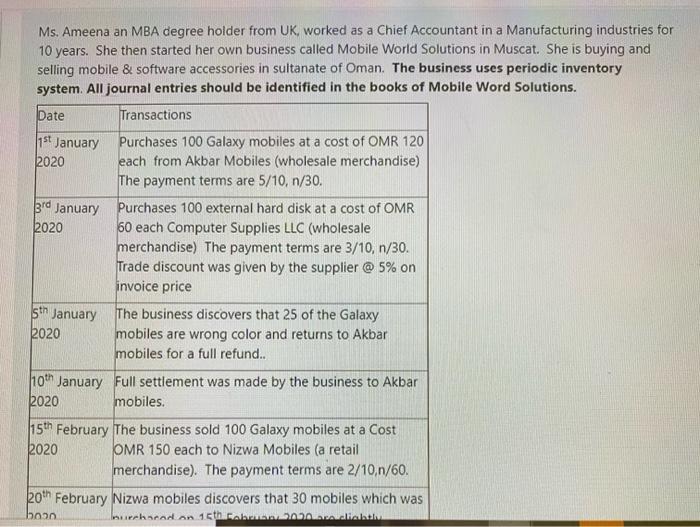

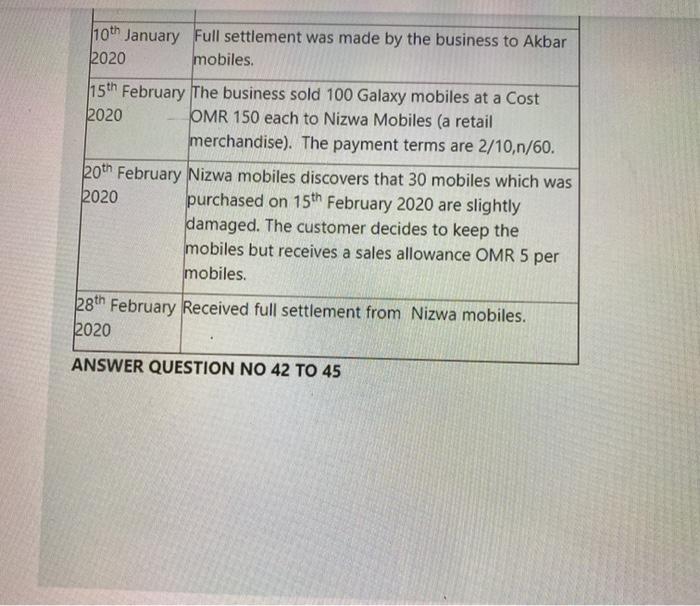

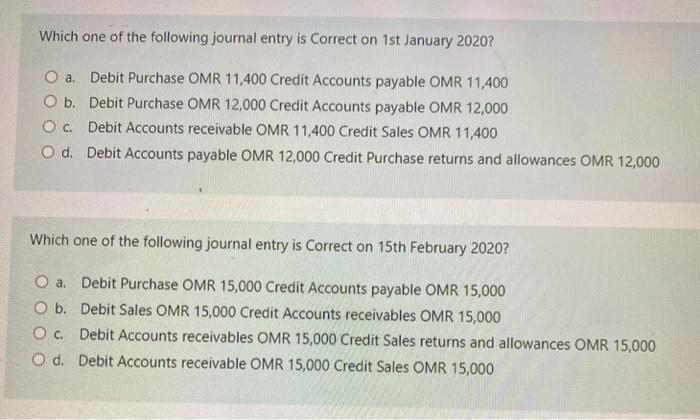

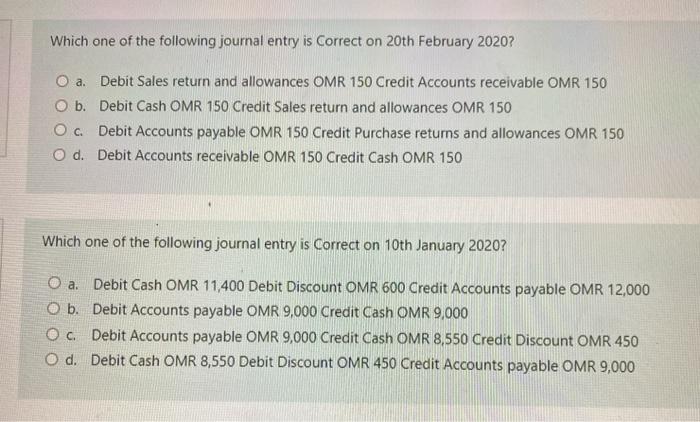

Ms. Ameena an MBA degree holder from UK, worked as a Chief Accountant in a Manufacturing industries for 10 years. She then started her own business called Mobile World Solutions in Muscat. She is buying and selling mobile & software accessories in sultanate of Oman. The business uses periodic inventory system. All journal entries should be identified in the books of Mobile Word Solutions. Date Transactions 1st January Purchases 100 Galaxy mobiles at a cost of OMR 120 2020 each from Akbar Mobiles (wholesale merchandise) The payment terms are 5/10, n/30. 3rd January Purchases 100 external hard disk at a cost of OMR 2020 60 each Computer Supplies LLC (wholesale merchandise) The payment terms are 3/10, n/30. Trade discount was given by the supplier @5% on invoice price sth January The business discovers that 25 of the Galaxy 2020 mobiles are wrong color and returns to Akbar mobiles for a full refund.. 10th January Full settlement was made by the business to Akbar 2020 mobiles 15th February The business sold 100 Galaxy mobiles at a Cost 2020 OMR 150 each to Nizwa Mobiles (a retail merchandise). The payment terms are 2/10,n/60. 20th February Nizwa mobiles discovers that 30 mobiles which was burchocodon 15th Rabat bon 10th January Full settlement was made by the business to Akbar 2020 mobiles. 15th February The business sold 100 Galaxy mobiles at a Cost 2020 OMR 150 each to Nizwa Mobiles (a retail merchandise). The payment terms are 2/10,n/60. 20th February Nizwa mobiles discovers that 30 mobiles which was 2020 purchased on 15th February 2020 are slightly damaged. The customer decides to keep the mobiles but receives a sales allowance OMR 5 per mobiles 28th February Received full settlement from Nizwa mobiles. 2020 ANSWER QUESTION NO 42 TO 45 Which one of the following journal entry is Correct on 1st January 2020? O a Debit Purchase OMR 11,400 Credit Accounts payable OMR 11,400 O b. Debit Purchase OMR 12,000 Credit Accounts payable OMR 12,000 Oc. Debit Accounts receivable OMR 11,400 Credit Sales OMR 11,400 O d. Debit Accounts payable OMR 12,000 Credit Purchase returns and allowances OMR 12,000 Which one of the following journal entry is Correct on 15th February 2020? O a. Debit Purchase OMR 15,000 Credit Accounts payable OMR 15,000 O b. Debit Sales OMR 15,000 Credit Accounts receivables OMR 15,000 Oc Debit Accounts receivables OMR 15,000 Credit Sales returns and allowances OMR 15,000 O d. Debit Accounts receivable OMR 15,000 Credit Sales OMR 15,000 Which one of the following journal entry is Correct on 20th February 2020? O a. Debit Sales return and allowances OMR 150 Credit Accounts receivable OMR 150 O b. Debit Cash OMR 150 Credit Sales return and allowances OMR 150 OC. Debit Accounts payable OMR 150 Credit Purchase returns and allowances OMR 150 O d. Debit Accounts receivable OMR 150 Credit Cash OMR 150 Which one of the following journal entry is Correct on 10th January 2020? O a. Debit Cash OMR 11,400 Debit Discount OMR 600 Credit Accounts payable OMR 12,000 O b. Debit Accounts payable OMR 9.000 Credit Cash OMR 9,000 Oc. Debit Accounts payable OMR 9,000 Credit Cash OMR 8,550 Credit Discount OMR 450 Od Debit Cash OMR 8,550 Debit Discount OMR 450 Credit Accounts payable OMR 9,000