Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ms. Ansley Johnson, an ambitious young financial analyst working for Bryant & Chen Financial Solutions, Ltd., is attempting to reconstruct a project analysis of

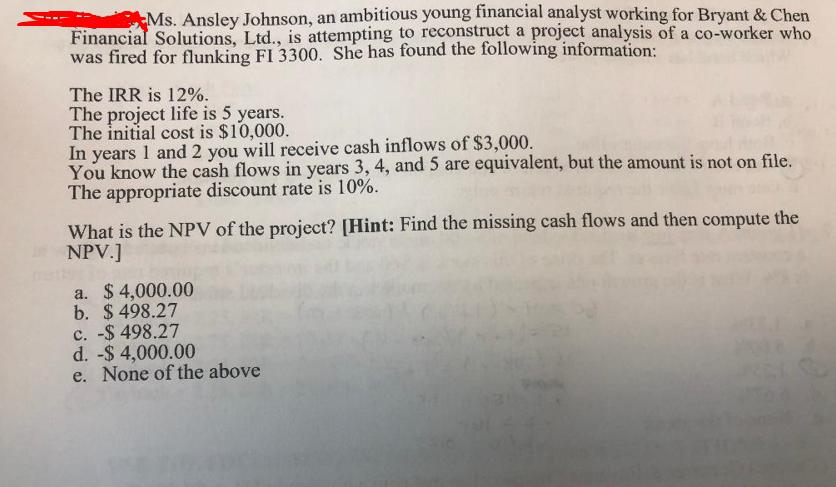

Ms. Ansley Johnson, an ambitious young financial analyst working for Bryant & Chen Financial Solutions, Ltd., is attempting to reconstruct a project analysis of a co-worker who was fired for flunking FI 3300. She has found the following information: The IRR is 12%. The project life is 5 years. The initial cost is $10,000. In years 1 and 2 you will receive cash inflows of $3,000. You know the cash flows in years 3, 4, and 5 are equivalent, but the amount is not on file. The appropriate discount rate is 10%. What is the NPV of the project? [Hint: Find the missing cash flows and then compute the NPV.] a. $4,000.00 b. $498.27 c. -$498.27 d. -$ 4,000.00 e. None of the above 2018

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the NPV of the project we need to find the missing cash flows for years 3 4 and 5 and t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started