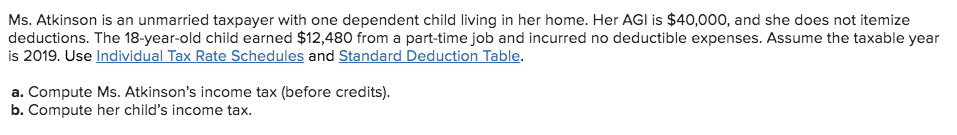

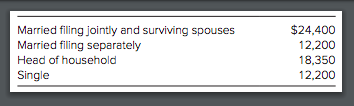

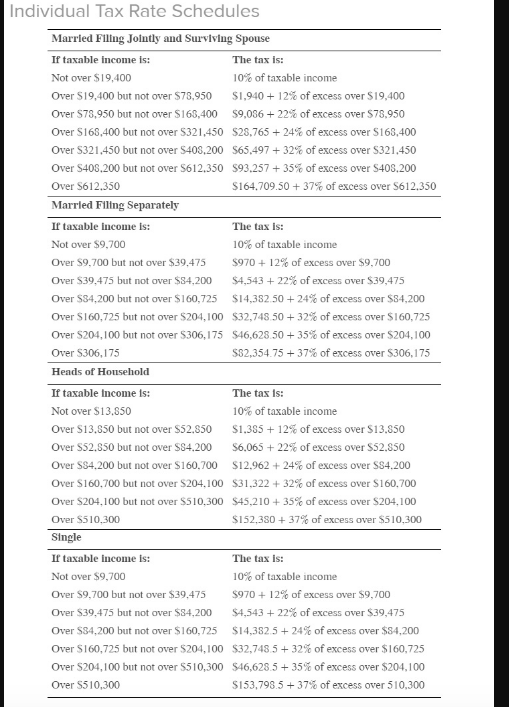

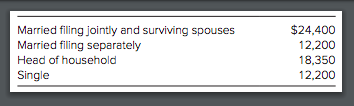

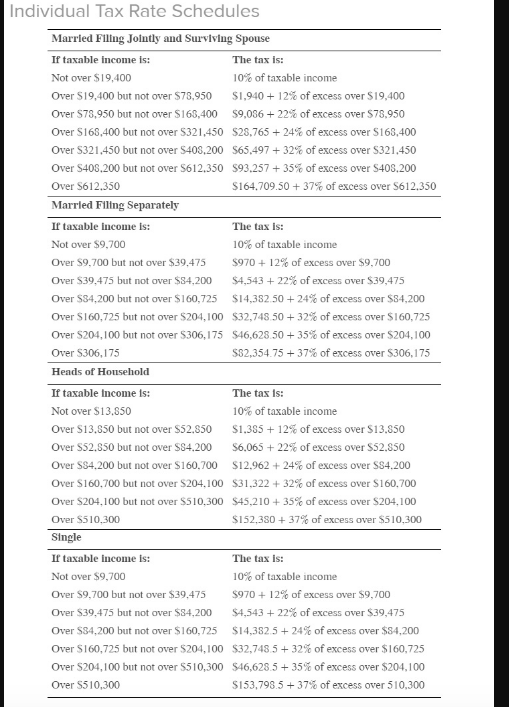

Ms. Atkinson is an unmarried taxpayer with one dependent child living in her home. Her AGI is $40,000, and she does not itemize deductions. The 18-year-old child earned $12,480 from a part-time job and incurred no deductible expenses. Assume the taxable year is 2019. Use Individual Tax Rate Schedules and Standard Deduction Table. a. Compute Ms. Atkinson's income tax (before credits). b. Compute her child's income tax. $24,400 Married filing jointly and surviving spouses Married filing separately 12,200 Head of household 18,350 Single 12,200 Individual Tax Rate Schedules Married Fillng Jolntly and Surviving Spouse The tax is If taxable Income is: 10% of taxable income Not over $19,400 Over S19,400 but not over $78,950 S1,94012% of excess over S19,400 S9,086 22% of excess over S78,950 Over S78,950 but not over S168,400 $28,76524% of excess over S168,400 S65,497 32% of excess over $321,450 $93.25735% of excess over S40s,200 $164,709.50 37% of excess over S612.350 Over S168,400 but not over S321,4500 Over $321,450 but not over $403,200 Over S408,200 but not over S612,350 Over S612.350 Married Filing Separately If taxable income is: The tax is: 10% of taxable income Not over $9,700 Over $9,700 but not over $39,475 $97012% of excess over S9,700 Over $39,475 but not over $84,200 $4,54322% of excess over $39,475 $14,382.5024 % of excess over $84,200 $32,748.5032 % of excess over $160,725 Over $34,200 but not over $160,725 Over $160,725 but not over $204,100 $46,628.5035% of excess over $204,100 Over $204,100 but not over $306,175 37 % of excess over S306,175 Over S306,175 S82,354.75 Heads of Household If taxable Income Is The tax is: Not over $13,850 10% of taxable income $1.38512% of excess over S13.850 Over S13.850 but not over S52.850 Over S52.850 but not over S84.200 S6,06522% of excess over S52.850 $12,962 24% of excess over S84.200 Over $160,700 but not over $204,100 $31,322 +32% of excess over $160,700 Over $204,100 but not over $510,300 $45,210 +35% of excess over $204,100 $152,380+37% of excess over $510,300 Over S84,200 but not over $160,700 Over $510,300 Single The tax is: If taxable income is: Not over $9,700 10% of taxable income Over $9,700 but not over $39.475 $97012% of excess over $9,700 $4,54322% of excess over $39,475 Over $39,475 but not over $84,200 $14,382.524 % of excess over $84,200 Over S34,200 but not over $160,725 $32,748532% of excess over $160,725 Over $160,725 but not over 5204,100 $46,628.535% of excess over $204,100 S153,798.5 37 % of excess over 510,300 Over $204,100 but not over S510,300 Over S510,300 Ms. Atkinson is an unmarried taxpayer with one dependent child living in her home. Her AGI is $40,000, and she does not itemize deductions. The 18-year-old child earned $12,480 from a part-time job and incurred no deductible expenses. Assume the taxable year is 2019. Use Individual Tax Rate Schedules and Standard Deduction Table. a. Compute Ms. Atkinson's income tax (before credits). b. Compute her child's income tax. $24,400 Married filing jointly and surviving spouses Married filing separately 12,200 Head of household 18,350 Single 12,200 Individual Tax Rate Schedules Married Fillng Jolntly and Surviving Spouse The tax is If taxable Income is: 10% of taxable income Not over $19,400 Over S19,400 but not over $78,950 S1,94012% of excess over S19,400 S9,086 22% of excess over S78,950 Over S78,950 but not over S168,400 $28,76524% of excess over S168,400 S65,497 32% of excess over $321,450 $93.25735% of excess over S40s,200 $164,709.50 37% of excess over S612.350 Over S168,400 but not over S321,4500 Over $321,450 but not over $403,200 Over S408,200 but not over S612,350 Over S612.350 Married Filing Separately If taxable income is: The tax is: 10% of taxable income Not over $9,700 Over $9,700 but not over $39,475 $97012% of excess over S9,700 Over $39,475 but not over $84,200 $4,54322% of excess over $39,475 $14,382.5024 % of excess over $84,200 $32,748.5032 % of excess over $160,725 Over $34,200 but not over $160,725 Over $160,725 but not over $204,100 $46,628.5035% of excess over $204,100 Over $204,100 but not over $306,175 37 % of excess over S306,175 Over S306,175 S82,354.75 Heads of Household If taxable Income Is The tax is: Not over $13,850 10% of taxable income $1.38512% of excess over S13.850 Over S13.850 but not over S52.850 Over S52.850 but not over S84.200 S6,06522% of excess over S52.850 $12,962 24% of excess over S84.200 Over $160,700 but not over $204,100 $31,322 +32% of excess over $160,700 Over $204,100 but not over $510,300 $45,210 +35% of excess over $204,100 $152,380+37% of excess over $510,300 Over S84,200 but not over $160,700 Over $510,300 Single The tax is: If taxable income is: Not over $9,700 10% of taxable income Over $9,700 but not over $39.475 $97012% of excess over $9,700 $4,54322% of excess over $39,475 Over $39,475 but not over $84,200 $14,382.524 % of excess over $84,200 Over S34,200 but not over $160,725 $32,748532% of excess over $160,725 Over $160,725 but not over 5204,100 $46,628.535% of excess over $204,100 S153,798.5 37 % of excess over 510,300 Over $204,100 but not over S510,300 Over S510,300