Answered step by step

Verified Expert Solution

Question

1 Approved Answer

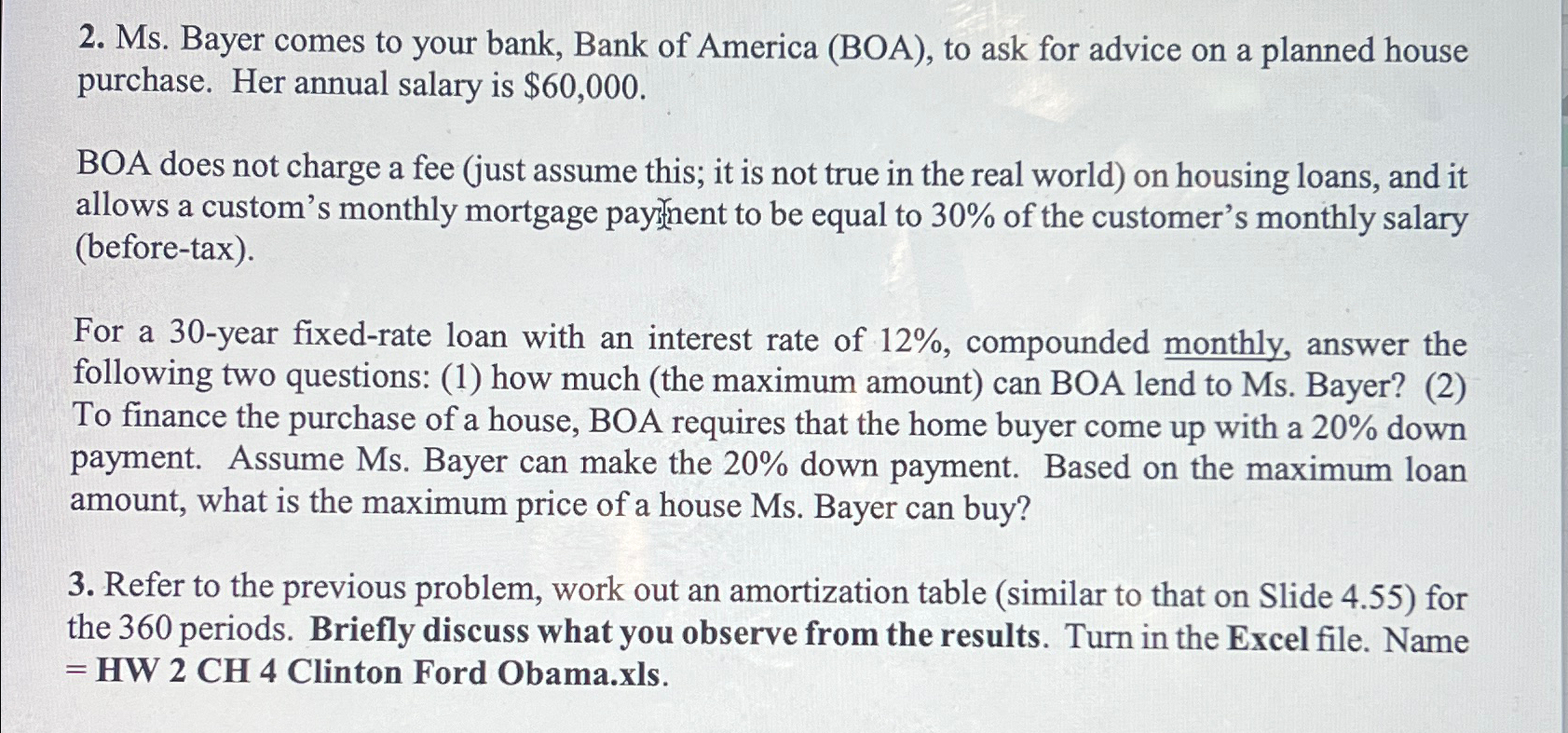

Ms . Bayer comes to your bank, Bank of America ( BOA ) , to ask for advice on a planned house purchase. Her annual

Ms Bayer comes to your bank, Bank of America BOA to ask for advice on a planned house purchase. Her annual salary is $

BOA does not charge a fee just assume this; it is not true in the real world on housing loans, and it allows a custom's monthly mortgage pays? beforetax

For a year fixedrate loan with an interest rate of compounded monthly, answer the following two questions: how much the maximum amount can BOA lend to Ms Bayer? To finance the purchase of a house, BOA requires that the home buyer come up with a down payment. Assume Ms Bayer can make the down payment. Based on the maximum loan amount, what is the maximum price of a house Ms Bayer can buy?

Refer to the previous problem, work out an amortization table similar to that on Slide for the periods. Briefly discuss what you observe from the results. Turn in the Excel file. Name HW CH Clinton Ford Obama.xls

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started