Answered step by step

Verified Expert Solution

Question

1 Approved Answer

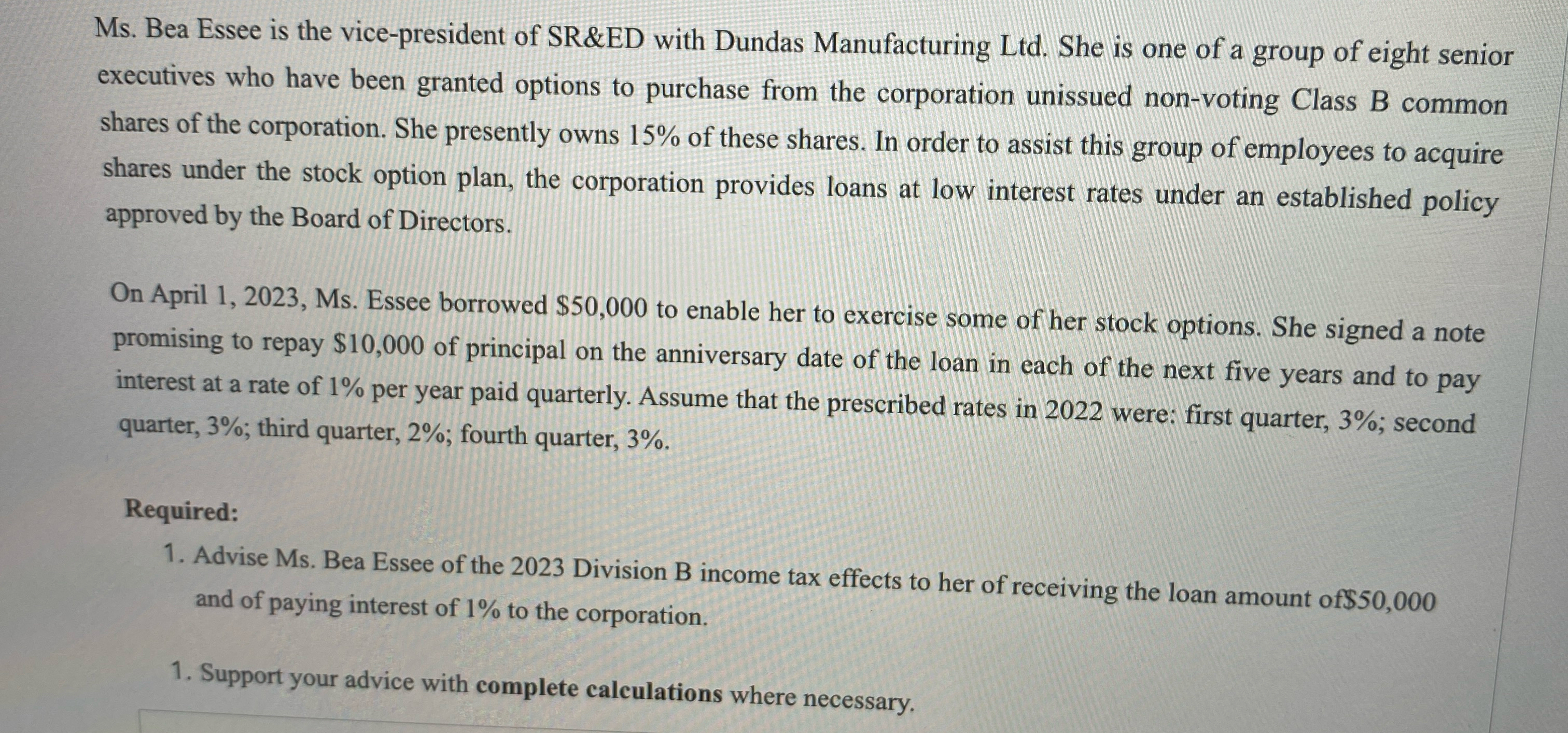

Ms . Bea Essee is the vice - president of SR&ED with Dundas Manufacturing Ltd . She is one of a group of eight senior

Ms Bea Essee is the vicepresident of SR&ED with Dundas Manufacturing Ltd She is one of a group of eight senior executives who have been granted options to purchase from the corporation unissued nonvoting Class B common shares of the corporation. She presently owns of these shares. In order to assist this group of employees to acquire shares under the stock option plan, the corporation provides loans at low interest rates under an established policy approved by the Board of Directors.

On April Ms Essee borrowed $ to enable her to exercise some of her stock options. She signed a note promising to repay $ of principal on the anniversary date of the loan in each of the next five years and to pay interest at a rate of per year paid quarterly. Assume that the prescribed rates in were: first quarter, ; second quarter, ; third quarter, ; fourth quarter,

Required:

Advise Ms Bea Essee of the Division B income tax effects to her of receiving the loan amount of $ and of paying interest of to the corporation.

Support your advice with complete calculations where necessary.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started