Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ms. Cathy, an employee of Red Orange Corporation normally is in the 25% bracket with P 720,000 of cash salary and no-tax free perquisites/benefits.

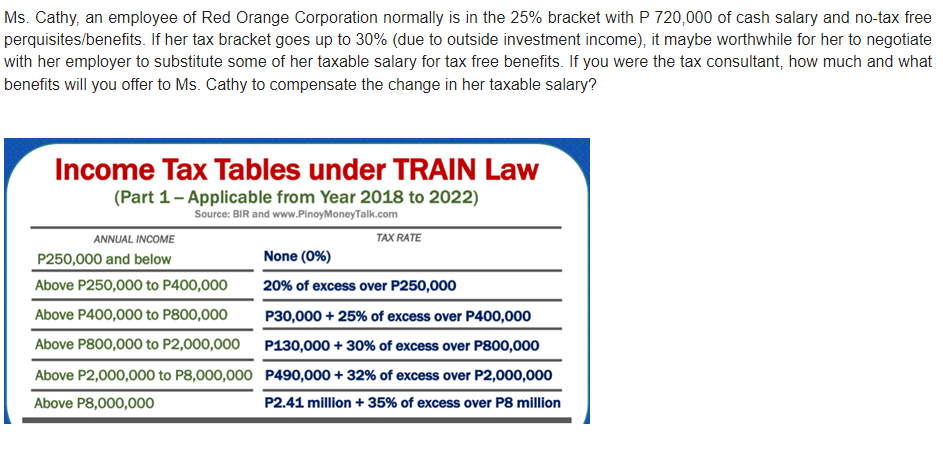

Ms. Cathy, an employee of Red Orange Corporation normally is in the 25% bracket with P 720,000 of cash salary and no-tax free perquisites/benefits. If her tax bracket goes up to 30% (due to outside investment income), it maybe worthwhile for her to negotiate with her employer to substitute some of her taxable salary for tax free benefits. If you were the tax consultant, how much and what benefits will you offer to Ms. Cathy to compensate the change in her taxable salary? Income Tax Tables under TRAIN Law (Part 1 - Applicable from Year 2018 to 2022) Source: BIR and www.PinoyMoneyTalk.com ANNUAL INCOME P250,000 and below Above P250,000 to P400,000 Above P400,000 to P800,000 Above P800,000 to P2,000,000 Above P2,000,000 to P8,000,000 Above P8,000,000 TAX RATE None (0%) 20% of excess over P250,000 P30,000 + 25% of excess over P400,000 P130,000 + 30% of excess over P800,000 P490,000 + 32% of excess over P2,000,000 P2.41 million + 35% of excess over P8 million

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To compensate for the increase in Ms Cathys tax bracket from 25 to 30 we need to determine the amoun...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started