Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ms. Chiu moved from Toronto to Vancouver to start a new job. She earned $40,000 from her Toronto job and $50,000 from her Vancouver

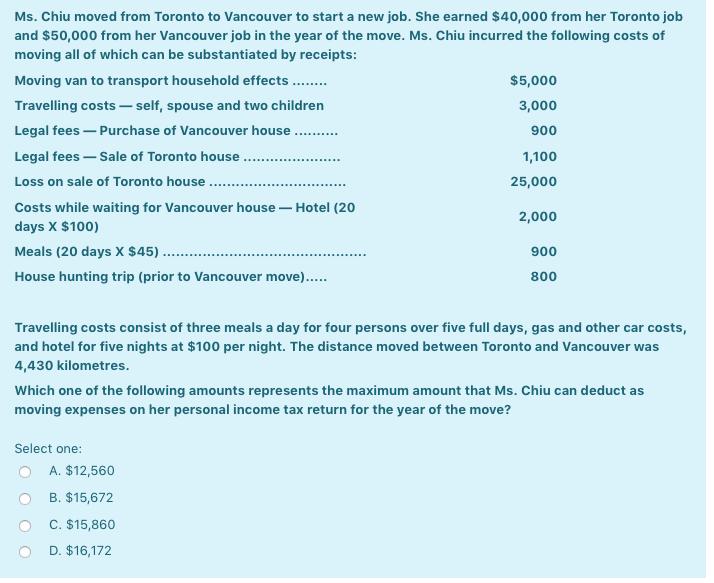

Ms. Chiu moved from Toronto to Vancouver to start a new job. She earned $40,000 from her Toronto job and $50,000 from her Vancouver job in the year of the move. Ms. Chiu incurred the following costs of moving all of which can be substantiated by receipts: Moving van to transport household effects....... Travelling costs-self, spouse and two children Legal fees - Purchase of Vancouver house........ Legal fees - Sale of Toronto house Loss on sale of Toronto house ..... Costs while waiting for Vancouver house - Hotel (20 days X $100) Meals (20 days X $45).. House hunting trip (prior to Vancouver move)..... $5,000 3,000 900 1,100 25,000 Select one: 2,000 Travelling costs consist of three meals a day for four persons over five full days, gas and other car costs, and hotel for five nights at $100 per night. The distance moved between Toronto and Vancouver was 4,430 kilometres. A. $12,560 B. $15,672 C. $15,860 D. $16,172 900 800 Which one of the following amounts represents the maximum amount that Ms. Chiu can deduct as moving expenses on her personal income tax return for the year of the move?

Step by Step Solution

★★★★★

3.39 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the maximum amount that Ms Chiu can deduct as moving expenses ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started