Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ms. Eli has $10,000 in pre-tax income that she does not need in the current year, but will require in two years to purchase a

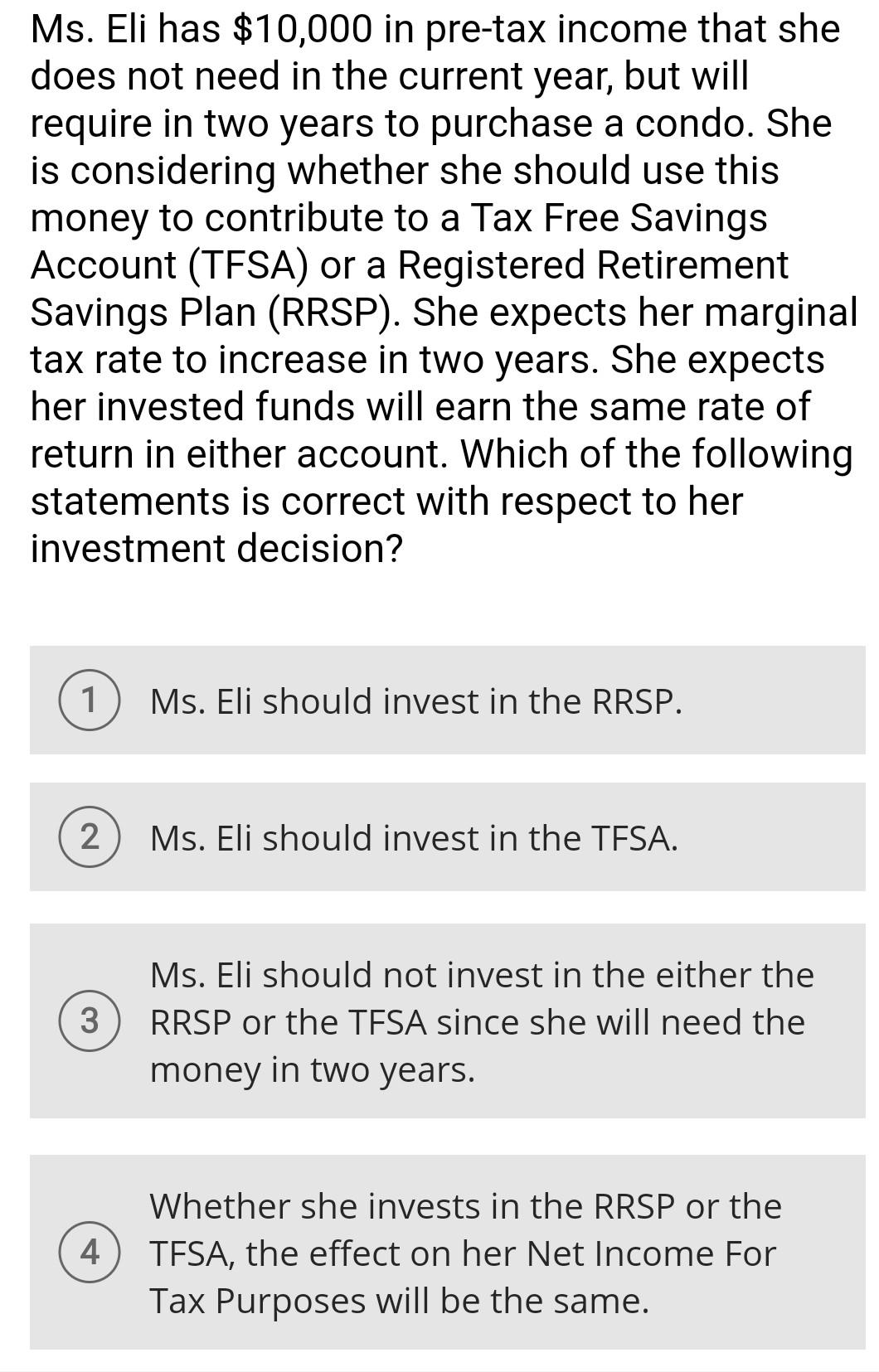

Ms. Eli has $10,000 in pre-tax income that she does not need in the current year, but will require in two years to purchase a condo. She is considering whether she should use this money to contribute to a Tax Free Savings Account (TFSA) or a Registered Retirement Savings Plan (RRSP). She expects her marginal tax rate to increase in two years. She expects her invested funds will earn the same rate of return in either account. Which of the following statements is correct with respect to her investment decision? 1 Ms. Eli should invest in the RRSP. 2 Ms. Eli should invest in the TFSA. 3 Ms. Eli should not invest in the either the RRSP or the TFSA since she will need the money in two years. 4 Whether she invests in the RRSP or the TFSA, the effect on her Net Income For Tax Purposes will be the same

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started