Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ms Koko is a bond portfolio manager who supports the pure expectations theory of the term structure of interest rates. Her portfolio includes two

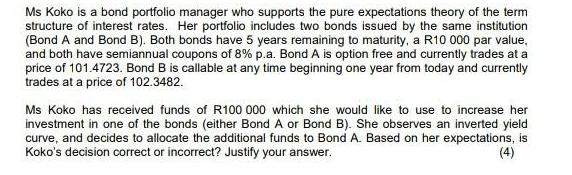

Ms Koko is a bond portfolio manager who supports the pure expectations theory of the term structure of interest rates. Her portfolio includes two bonds issued by the same institution (Bond A and Bond B). Both bonds have 5 years remaining to maturity, a R10 000 par value, and both have semiannual coupons of 8% p.a. Bond A is option free and currently trades at a price of 101.4723. Bond B is callable at any time beginning one year from today and currently trades at a price of 102.3482. Ms Koko has received funds of R100 000 which she would like to use to increase her investment in one of the bonds (either Bond A or Bond B). She observes an inverted yield curve, and decides to allocate the additional funds to Bond A. Based on her expectations, is Koko's decision correct or incorrect? Justify your answer. (4)

Step by Step Solution

★★★★★

3.58 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

Ms Kokos decision to allocate the additional funds to Bond A is likely incorrect given the information provided especially in the context of an inverted yield curve Lets break down the factors to unde...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started