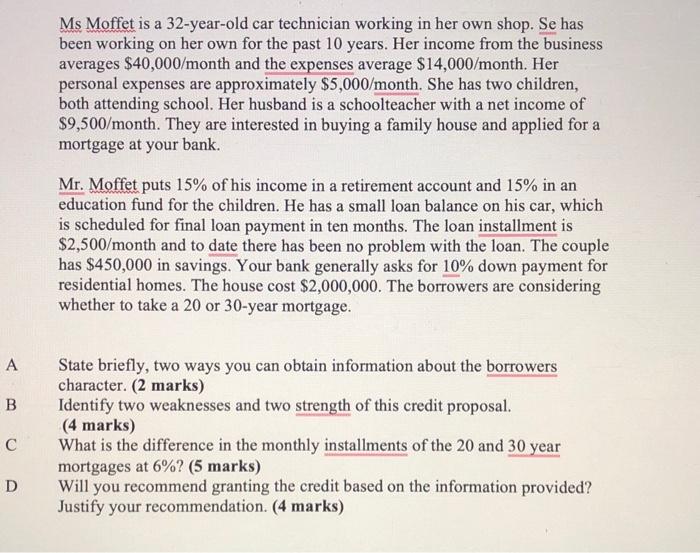

Ms Moffet is a 32-year-old car technician working in her own shop. Se has been working on her own for the past 10 years. Her income from the business averages $40,000/ month and the expenses average $14,000/ month. Her personal expenses are approximately $5,000/ month. She has two children, both attending school. Her husband is a schoolteacher with a net income of $9,500 /month. They are interested in buying a family house and applied for a mortgage at your bank. Mr. Moffet puts 15% of his income in a retirement account and 15% in an education fund for the children. He has a small loan balance on his car, which is scheduled for final loan payment in ten months. The loan installment is $2,500 /month and to date there has been no problem with the loan. The couple has $450,000 in savings. Your bank generally asks for 10% down payment for residential homes. The house cost $2,000,000. The borrowers are considering whether to take a 20 or 30 -year mortgage. State briefly, two ways you can obtain information about the borrowers character. (2 marks) Identify two weaknesses and two strength of this credit proposal. (4 marks) What is the difference in the monthly installments of the 20 and 30 year mortgages at 6\%? (5 marks) Will you recommend granting the credit based on the information provided? Justify your recommendation. (4 marks) Ms Moffet is a 32-year-old car technician working in her own shop. Se has been working on her own for the past 10 years. Her income from the business averages $40,000/ month and the expenses average $14,000/ month. Her personal expenses are approximately $5,000/ month. She has two children, both attending school. Her husband is a schoolteacher with a net income of $9,500 /month. They are interested in buying a family house and applied for a mortgage at your bank. Mr. Moffet puts 15% of his income in a retirement account and 15% in an education fund for the children. He has a small loan balance on his car, which is scheduled for final loan payment in ten months. The loan installment is $2,500 /month and to date there has been no problem with the loan. The couple has $450,000 in savings. Your bank generally asks for 10% down payment for residential homes. The house cost $2,000,000. The borrowers are considering whether to take a 20 or 30 -year mortgage. State briefly, two ways you can obtain information about the borrowers character. (2 marks) Identify two weaknesses and two strength of this credit proposal. (4 marks) What is the difference in the monthly installments of the 20 and 30 year mortgages at 6\%? (5 marks) Will you recommend granting the credit based on the information provided? Justify your recommendation. (4 marks)