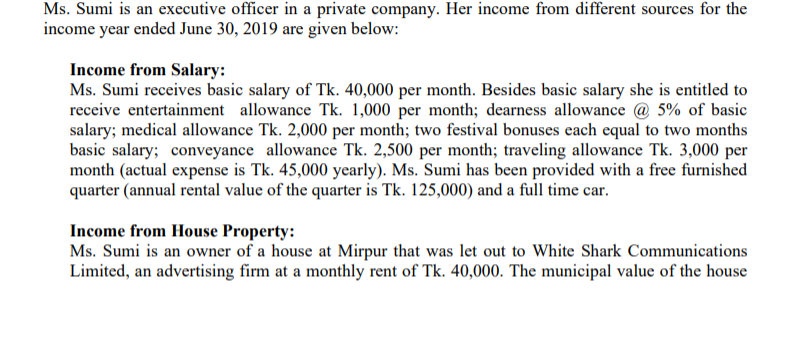

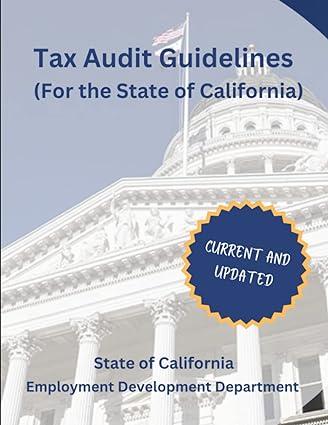

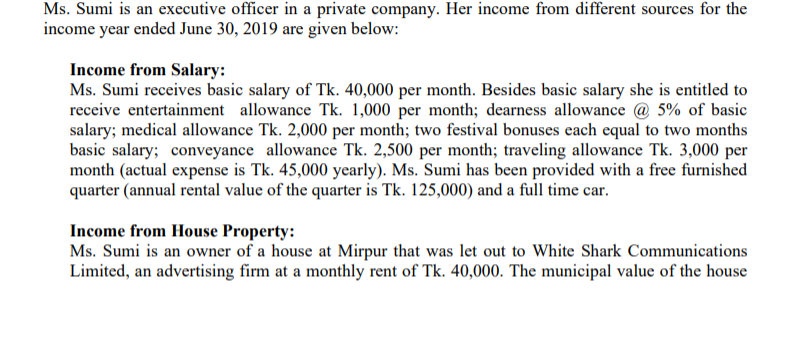

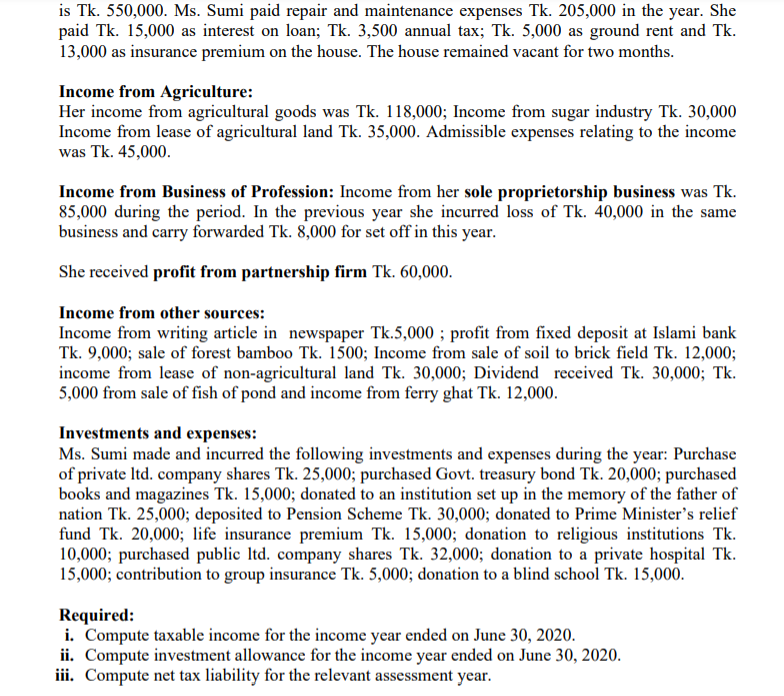

Ms. Sumi is an executive officer in a private company. Her income from different sources for the income year ended June 30, 2019 are given below: Income from Salary: Ms. Sumi receives basic salary of Tk. 40,000 per month. Besides basic salary she is entitled to receive entertainment allowance Tk. 1,000 per month; dearness allowance @ 5% of basic salary; medical allowance Tk. 2,000 per month; two festival bonuses each equal to two months basic salary; conveyance allowance Tk. 2,500 per month; traveling allowance Tk. 3,000 per month (actual expense is Tk. 45,000 yearly). Ms. Sumi has been provided with a free furnished quarter (annual rental value of the quarter is Tk. 125,000) and a full time car. Income from House Property: Ms. Sumi is an owner of a house at Mirpur that was let out to White Shark Communications Limited, an advertising firm at a monthly rent of Tk. 40,000. The municipal value of the house is Tk. 550,000. Ms. Sumi paid repair and maintenance expenses Tk. 205,000 in the year. She paid Tk. 15,000 as interest on loan; Tk. 3,500 annual tax; Tk. 5,000 as ground rent and Tk. 13,000 as insurance premium on the house. The house remained vacant for two months. Income from Agriculture: Her income from agricultural goods was Tk. 118,000; Income from sugar industry Tk. 30,000 Income from lease of agricultural land Tk. 35,000. Admissible expenses relating to the income was Tk. 45,000 Income from Business of Profession: Income from her sole proprietorship business was Tk. 85,000 during the period. In the previous year she incurred loss of Tk. 40,000 in the same business and carry forwarded Tk. 8,000 for set off in this year. She received profit from partnership firm Tk. 60,000. Income from other sources: Income from writing article in newspaper Tk.5,000 ; profit from fixed deposit at Islami bank Tk. 9,000; sale of forest bamboo Tk. 1500; Income from sale of soil to brick field Tk. 12,000; income from lease of non-agricultural land Tk. 30,000; Dividend received Tk. 30,000; Tk. 5,000 from sale of fish of pond and income from ferry ghat Tk. 12,000. Investments and expenses: Ms. Sumi made and incurred the following investments and expenses during the year: Purchase of private ltd. company shares Tk. 25,000; purchased Govt. treasury bond Tk. 20,000; purchased books and magazines Tk. 15,000; donated to an institution set up in the memory of the father of nation Tk. 25,000; deposited to Pension Scheme Tk. 30,000; donated to Prime Minister's relief fund Tk. 20,000; life insurance premium Tk. 15,000; donation to religious institutions Tk. 10,000; purchased public ltd. company shares Tk. 32,000; donation to a private hospital Tk. 15,000; contribution to group insurance Tk. 5,000; donation to a blind school Tk. 15,000. Required: i. Compute taxable income for the income year ended on June 30, 2020. ii. Compute investment allowance for the income year ended on June 30, 2020. iii. Compute net tax liability for the relevant assessment year. Ms. Sumi is an executive officer in a private company. Her income from different sources for the income year ended June 30, 2019 are given below: Income from Salary: Ms. Sumi receives basic salary of Tk. 40,000 per month. Besides basic salary she is entitled to receive entertainment allowance Tk. 1,000 per month; dearness allowance @ 5% of basic salary; medical allowance Tk. 2,000 per month; two festival bonuses each equal to two months basic salary; conveyance allowance Tk. 2,500 per month; traveling allowance Tk. 3,000 per month (actual expense is Tk. 45,000 yearly). Ms. Sumi has been provided with a free furnished quarter (annual rental value of the quarter is Tk. 125,000) and a full time car. Income from House Property: Ms. Sumi is an owner of a house at Mirpur that was let out to White Shark Communications Limited, an advertising firm at a monthly rent of Tk. 40,000. The municipal value of the house is Tk. 550,000. Ms. Sumi paid repair and maintenance expenses Tk. 205,000 in the year. She paid Tk. 15,000 as interest on loan; Tk. 3,500 annual tax; Tk. 5,000 as ground rent and Tk. 13,000 as insurance premium on the house. The house remained vacant for two months. Income from Agriculture: Her income from agricultural goods was Tk. 118,000; Income from sugar industry Tk. 30,000 Income from lease of agricultural land Tk. 35,000. Admissible expenses relating to the income was Tk. 45,000 Income from Business of Profession: Income from her sole proprietorship business was Tk. 85,000 during the period. In the previous year she incurred loss of Tk. 40,000 in the same business and carry forwarded Tk. 8,000 for set off in this year. She received profit from partnership firm Tk. 60,000. Income from other sources: Income from writing article in newspaper Tk.5,000 ; profit from fixed deposit at Islami bank Tk. 9,000; sale of forest bamboo Tk. 1500; Income from sale of soil to brick field Tk. 12,000; income from lease of non-agricultural land Tk. 30,000; Dividend received Tk. 30,000; Tk. 5,000 from sale of fish of pond and income from ferry ghat Tk. 12,000. Investments and expenses: Ms. Sumi made and incurred the following investments and expenses during the year: Purchase of private ltd. company shares Tk. 25,000; purchased Govt. treasury bond Tk. 20,000; purchased books and magazines Tk. 15,000; donated to an institution set up in the memory of the father of nation Tk. 25,000; deposited to Pension Scheme Tk. 30,000; donated to Prime Minister's relief fund Tk. 20,000; life insurance premium Tk. 15,000; donation to religious institutions Tk. 10,000; purchased public ltd. company shares Tk. 32,000; donation to a private hospital Tk. 15,000; contribution to group insurance Tk. 5,000; donation to a blind school Tk. 15,000. Required: i. Compute taxable income for the income year ended on June 30, 2020. ii. Compute investment allowance for the income year ended on June 30, 2020. iii. Compute net tax liability for the relevant assessment year