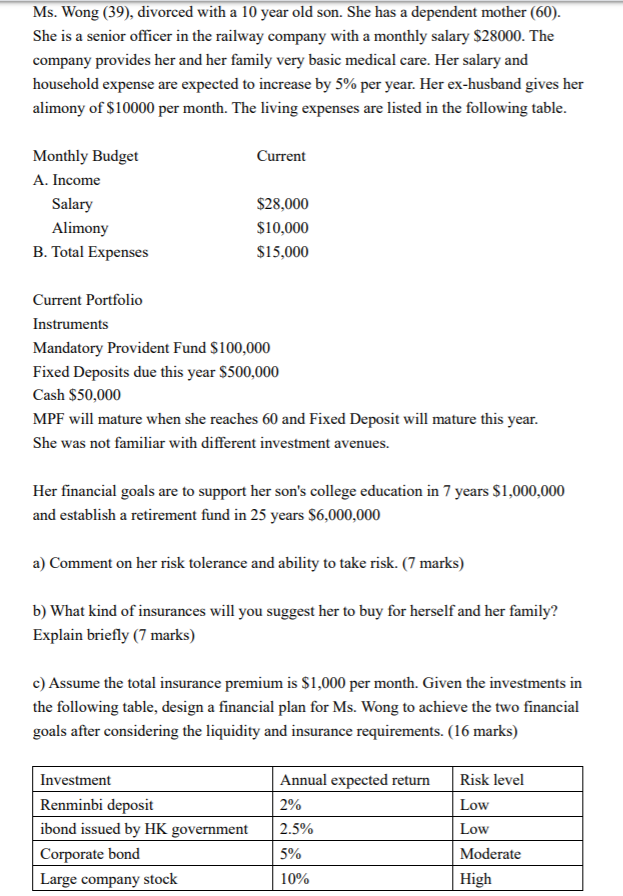

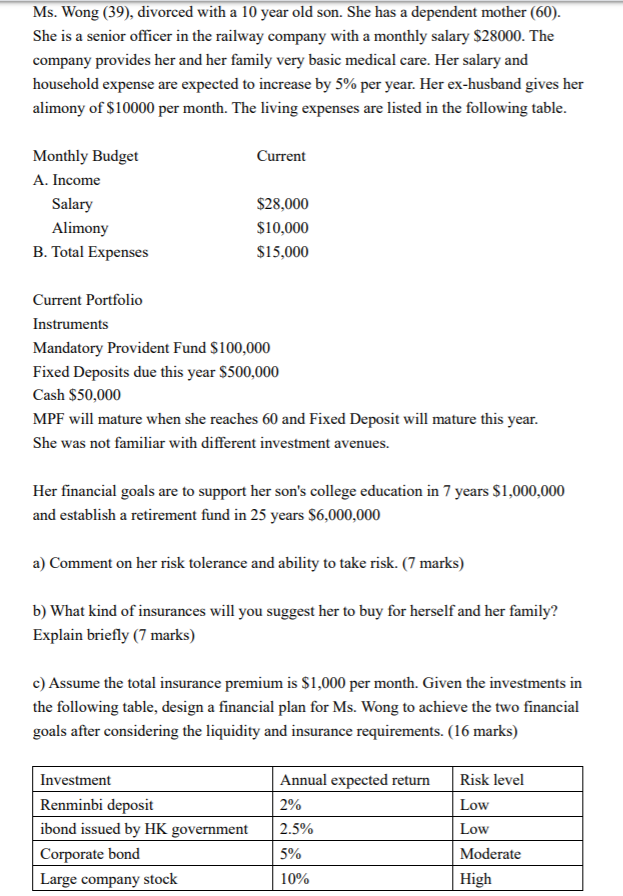

Ms. Wong (39), divorced with a 10 year old son. She has a dependent mother (60). She is a senior officer in the railway company with a monthly salary $28000. The company provides her and her family very basic medical care. Her salary and household expense are expected to increase by 5% per year. Her ex-husband gives her alimony of $10000 per month. The living expenses are listed in the following table. Current Monthly Budget A. Income Salary Alimony B. Total Expenses $28,000 $10,000 $15,000 Current Portfolio Instruments Mandatory Provident Fund $100,000 Fixed Deposits due this year $500,000 Cash $50,000 MPF will mature when she reaches 60 and Fixed Deposit will mature this year. She was not familiar with different investment avenues. Her financial goals are to support her son's college education in 7 years $1,000,000 and establish a retirement fund in 25 years $6,000,000 a) Comment on her risk tolerance and ability to take risk. (7 marks) b) What kind of insurances will you suggest her to buy for herself and her family? Explain briefly (7 marks) c) Assume the total insurance premium is $1,000 per month. Given the investments in the following table, design a financial plan for Ms. Wong to achieve the two financial goals after considering the liquidity and insurance requirements. (16 marks) Investment Renminbi deposit ibond issued by HK government Corporate bond Large company stock Annual expected return 2% 2.5% 5% 10% Risk level Low Low Moderate High Ms. Wong (39), divorced with a 10 year old son. She has a dependent mother (60). She is a senior officer in the railway company with a monthly salary $28000. The company provides her and her family very basic medical care. Her salary and household expense are expected to increase by 5% per year. Her ex-husband gives her alimony of $10000 per month. The living expenses are listed in the following table. Current Monthly Budget A. Income Salary Alimony B. Total Expenses $28,000 $10,000 $15,000 Current Portfolio Instruments Mandatory Provident Fund $100,000 Fixed Deposits due this year $500,000 Cash $50,000 MPF will mature when she reaches 60 and Fixed Deposit will mature this year. She was not familiar with different investment avenues. Her financial goals are to support her son's college education in 7 years $1,000,000 and establish a retirement fund in 25 years $6,000,000 a) Comment on her risk tolerance and ability to take risk. (7 marks) b) What kind of insurances will you suggest her to buy for herself and her family? Explain briefly (7 marks) c) Assume the total insurance premium is $1,000 per month. Given the investments in the following table, design a financial plan for Ms. Wong to achieve the two financial goals after considering the liquidity and insurance requirements. (16 marks) Investment Renminbi deposit ibond issued by HK government Corporate bond Large company stock Annual expected return 2% 2.5% 5% 10% Risk level Low Low Moderate High