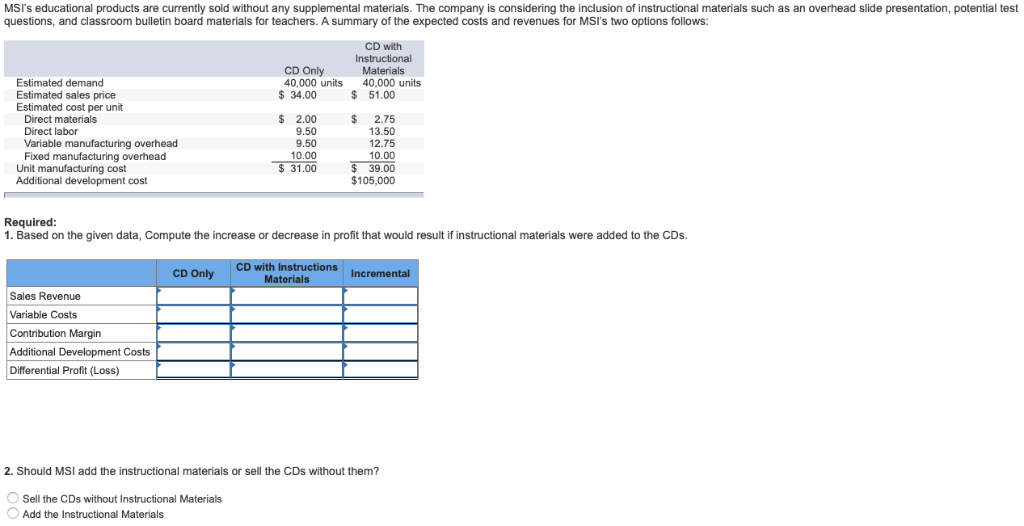

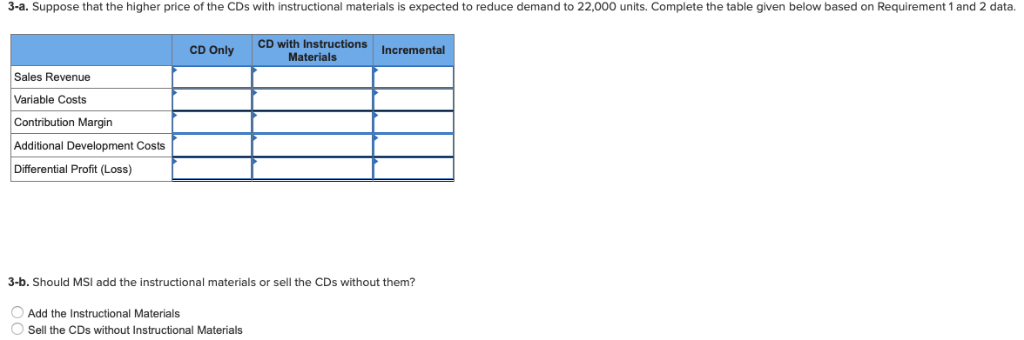

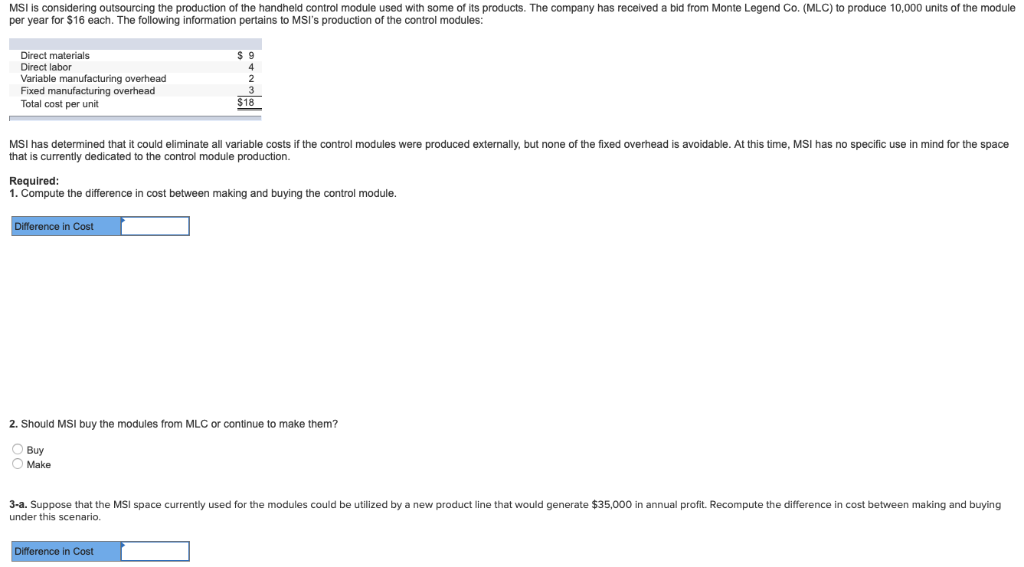

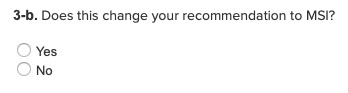

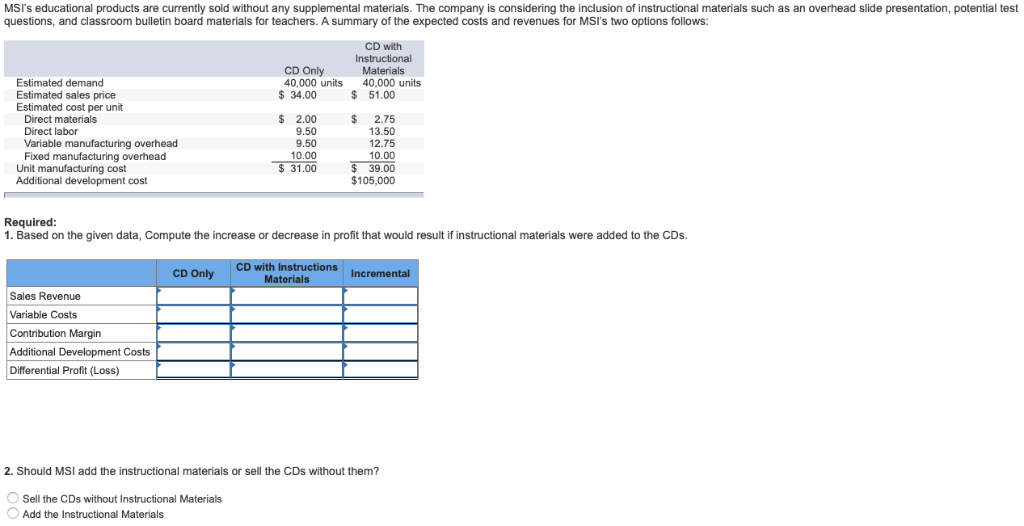

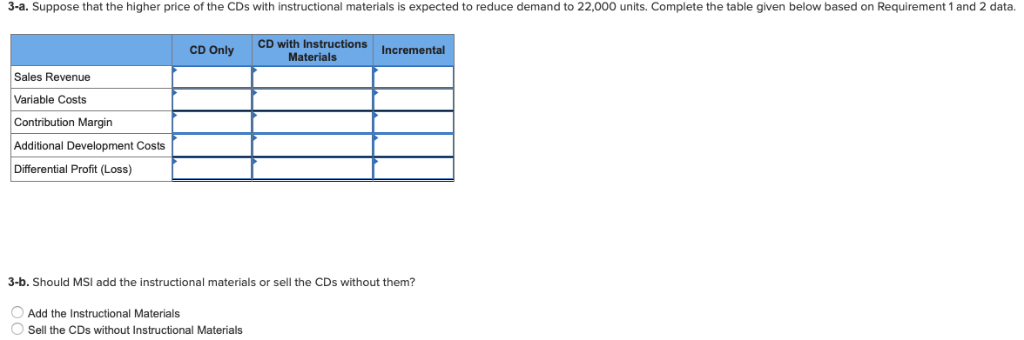

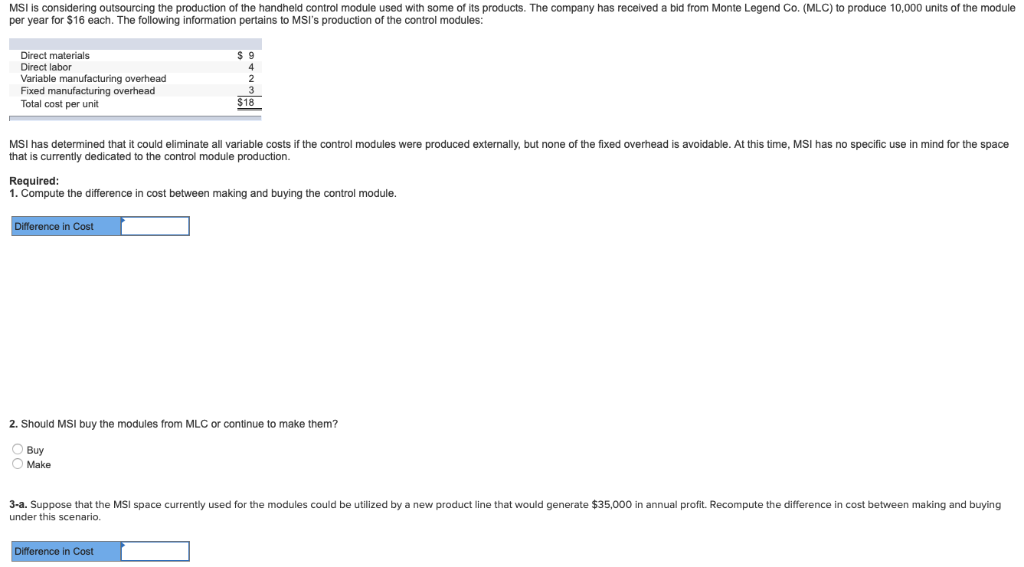

MSI's educational products are currently sold without any supplemental materials. The company is considering the inclusion of instructional materials such as an overhead slide presentation, potential test questions, and classroom bulletin board materials for teachers. A summary of the expected costs and revenues for MSI's two options follows: CD with Instructional CD Only 40,000 units Materials 40,000 units Estimated demand Estimated sales price Estimated cost per unit 34.00 $ 51.00 Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead $ 2.00 9.50 9.50 10.00 $ 2.75 13.50 12.75 10.00 31.00 39.00 $105,000 Unit manufacturing cost Additional development cost Required 1. Based on the given data, Compute the increase or decrease in profit that would result if instructional materials were added to the CDs. CD with CD Only Incremental Materials Sales Revenue Variable Costs Contribution Margirn Additional Development Costs Differential Profit (Loss) 2. Should MSI add the instructional materials or sell the CDs without them? Sell the CDs without Instructional Materials Add the Instructional Materials 3-a. Suppose that the higher price of the CDs with instructional materials is expected to reduce demand to 22,000 units. Complete the table given below based on Requirement 1 and 2 data CD with Instructions Materials CD Only Incremental Sales Revenue Variable Costs Contribution Margin Additional Development Costs Differential Profit (Loss) 3-b. Should MSI add the instructional materials or sell the CDs without them? O Add the Instructional Materials Sell the CDs without Instructional Materials MSI is considering outsourcing the production o the handheld control module used with some o its products. The company as received a bid per year for $16 each. The following information pertains to MSI's production of the control modules on Monte Legend o. ro uce toj 00 units of ne module $ 9 Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Total cost per unit $18 MSI has determined that it could eliminate all variable costs if the control modules were produced externally, but none of the fixed overhead is avoidable. At this time, MSl has no specific use in mind for the space that is currently dedicated to the control module production. Required: 1. Compute the difference in cost between making and buying the control module. in Cost 2. Should MSI buy the modules from MLC or continue to make them? Buy Make 3-a. Suppose that the MSI space currently used for the modules could be utilized by a new product line that would generate $35,000 in annual profit. Recompute the difference in cost between making and buying under this scenario. in Cost 3-b. Does this change your recommendation to MSI? Yes No