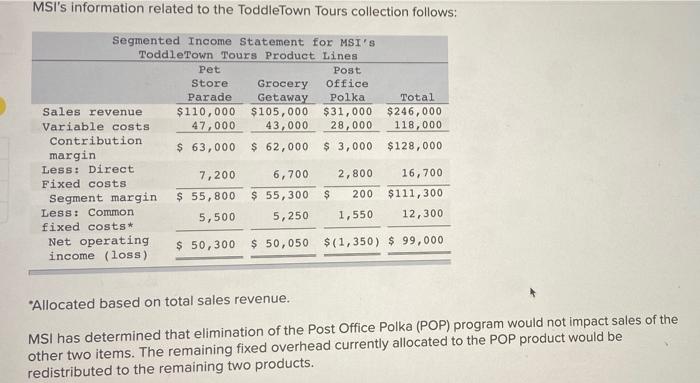

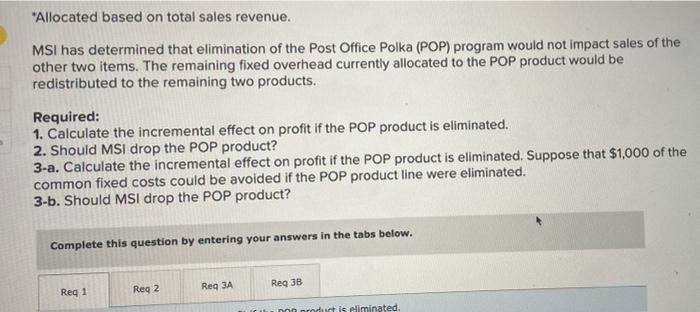

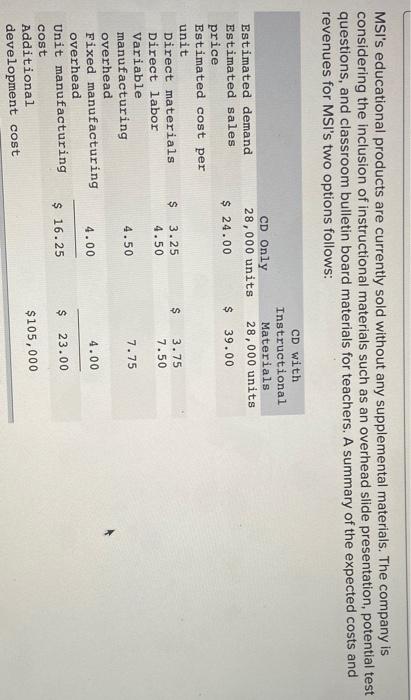

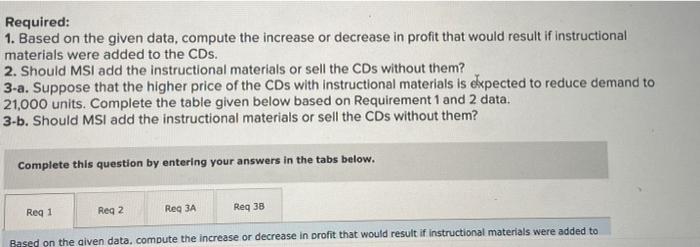

MSI's information related to the ToddleTown Tours collection follows: Segmented Income Statement for MSI'S ToddleTown Tours Product Lines Pet Post Store Grocery Office Parade Getaway Polka Total Sales revenue $110,000 $105,000 $31,000 $246,000 Variable costs 47,000 43,000 28,000 118,000 Contribution $ 63,000 $ 62,000 $ 3,000 margin $128,000 Less: Direct 7,200 6,700 Fixed costs 2,800 16,700 Segment margin $ 55,800 $ 55,300 $ 200 $111,300 Less: Common 5,500 5,250 1,550 12,300 fixed costs* Net operating $ 50,300 $ 50,050 $(1,350) $ 99,000 income (loss) *Allocated based on total sales revenue. MSI has determined that elimination of the Post Office Polka (POP) program would not impact sales of the other two items. The remaining fixed overhead currently allocated to the POP product would be redistributed to the remaining two products. "Allocated based on total sales revenue. MSI has determined that elimination of the Post Office Polka (POP) program would not impact sales of the other two items. The remaining fixed overhead currently allocated to the POP product would be redistributed to the remaining two products. Required: 1. Calculate the incremental effect on profit if the POP product is eliminated. 2. Should MSI drop the POP product? 3-a. Calculate the incremental effect on profit if the POP product is eliminated. Suppose that $1,000 of the common fixed costs could be avoided if the POP product line were eliminated. 3-b. Should MSI drop the POP product? Complete this question by entering your answers in the tabs below. Reg 3A Reg 3B Reg 1 Reg 2 in noduct is eliminated MSI's educational products are currently sold without any supplemental materials. The company is considering the inclusion of instructional materials such as an overhead slide presentation, potential test questions, and classroom bulletin board materials for teachers. A summary of the expected costs and revenues for MSI's two options follows: CD Only 28,000 units $ 24.00 CD with Instructional Materials 28,000 units $ 39.00 $ $ 3.25 4.50 3.75 7.50 Estimated demand Estimated sales price Estimated cost per unit Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Unit manufacturing cost Additional development cost 4.50 7.75 4.00 4.00 $ 16.25 $ 23.00 $ 105,000 Required: 1. Based on the given data, compute the increase or decrease in profit that would result if instructional materials were added to the CDs. 2. Should MSI add the instructional materials or sell the CDs without them? 3-a. Suppose that the higher price of the CDs with instructional materials is expected to reduce demand to 21,000 units. Complete the table given below based on Requirement 1 and 2 data. 3-b. Should MSI add the instructional materials or sell the CDs without them? Complete this question by entering your answers in the tabs below. Reg 1 Reg 2 Reg 3A Reg 38 Based on the given data. compute the increase or decrease in profit that would result if instructional materials were added to