Answered step by step

Verified Expert Solution

Question

1 Approved Answer

MT Corporation has decided to replace an older model machine with a newer model machine. The old machine cost $60,000 two years ago and

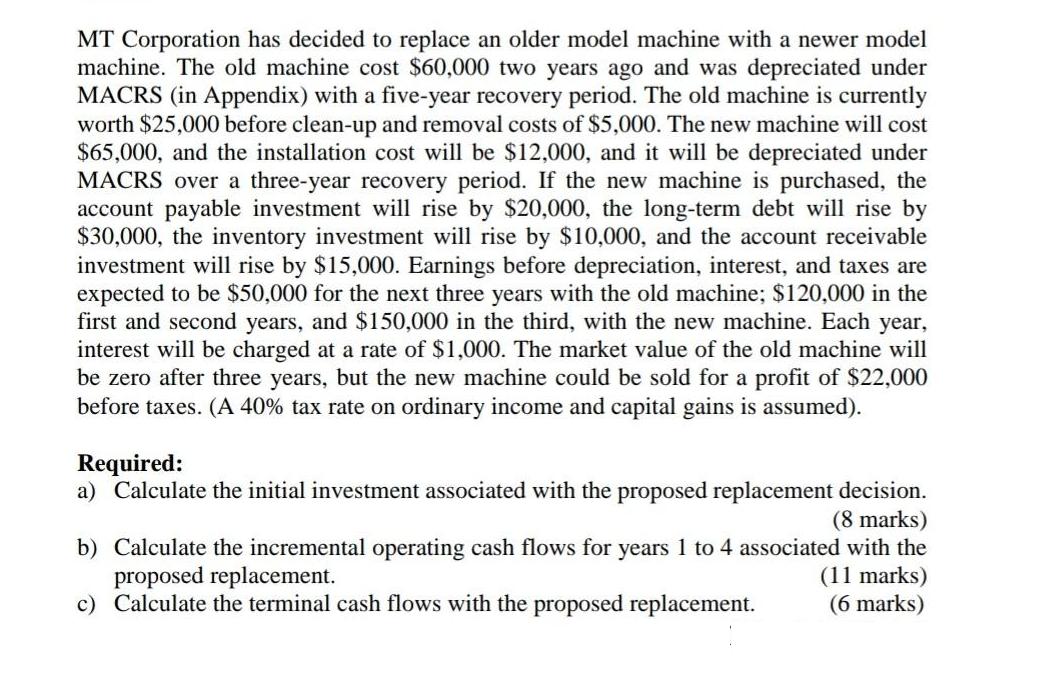

MT Corporation has decided to replace an older model machine with a newer model machine. The old machine cost $60,000 two years ago and was depreciated under MACRS (in Appendix) with a five-year recovery period. The old machine is currently worth $25,000 before clean-up and removal costs of $5,000. The new machine will cost $65,000, and the installation cost will be $12,000, and it will be depreciated under MACRS over a three-year recovery period. If the new machine is purchased, the account payable investment will rise by $20,000, the long-term debt will rise by $30,000, the inventory investment will rise by $10,000, and the account receivable investment will rise by $15,000. Earnings before depreciation, interest, and taxes are expected to be $50,000 for the next three years with the old machine; $120,000 in the first and second years, and $150,000 in the third, with the new machine. Each year, interest will be charged at a rate of $1,000. The market value of the old machine will be zero after three years, but the new machine could be sold for a profit of $22,000 before taxes. (A 40% tax rate on ordinary income and capital gains is assumed). Required: a) Calculate the initial investment associated with the proposed replacement decision. (8 marks) b) Calculate the incremental operating cash flows for years 1 to 4 associated with the proposed replacement. c) Calculate the terminal cash flows with the proposed replacement. (11 marks) (6 marks)

Step by Step Solution

★★★★★

3.36 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Calculate the initial investment associated with the proposed replacement decision The initial investment for the proposed replacement machine is 1370...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started