MTC Corporation's top management wants to measure the company's overall cost of capital. The following data were gathered by their finance department: The firm's

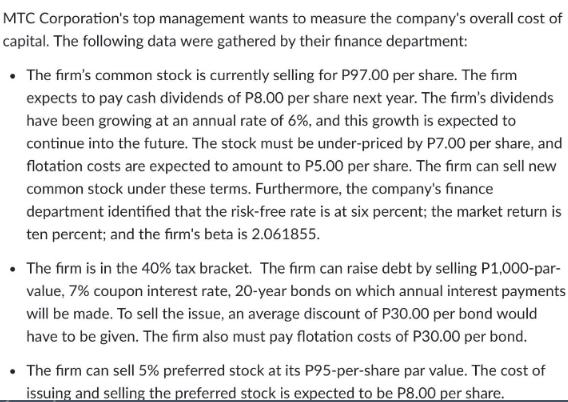

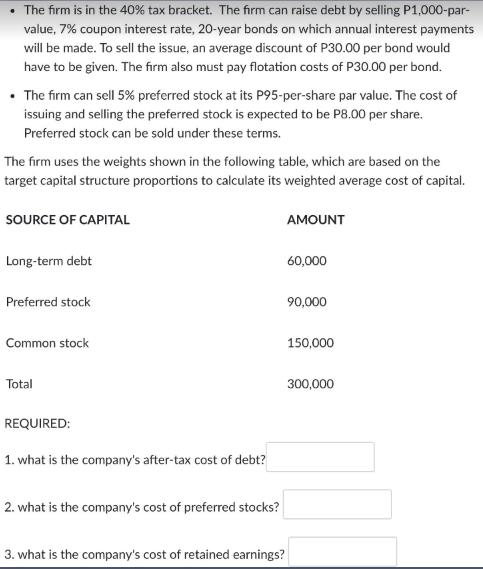

MTC Corporation's top management wants to measure the company's overall cost of capital. The following data were gathered by their finance department: The firm's common stock is currently selling for P97.00 per share. The firm expects to pay cash dividends of P8.00 per share next year. The firm's dividends have been growing at an annual rate of 6%, and this growth is expected to continue into the future. The stock must be under-priced by P7.00 per share, and flotation costs are expected to amount to P5.00 per share. The firm can sell new common stock under these terms. Furthermore, the company's finance department identified that the risk-free rate is at six percent; the market return is ten percent; and the firm's beta is 2.061855. The firm is in the 40% tax bracket. The firm can raise debt by selling P1,000-par- value, 7% coupon interest rate, 20-year bonds on which annual interest payments will be made. To sell the issue, an average discount of P30.00 per bond would have to be given. The firm also must pay flotation costs of P30.00 per bond. The firm can sell 5% preferred stock at its P95-per-share par value. The cost of issuing and selling the preferred stock is expected to be P8.00 per share. The firm is in the 40% tax bracket. The firm can raise debt by selling P1,000-par- value, 7% coupon interest rate, 20-year bonds on which annual interest payments will be made. To sell the issue, an average discount of P30.00 per bond would have to be given. The firm also must pay flotation costs of P30.00 per bond. The firm can sell 5% preferred stock at its P95-per-share par value. The cost of issuing and selling the preferred stock is expected to be P8.00 per share. Preferred stock can be sold under these terms. The firm uses the weights shown in the following table, which are based on the target capital structure proportions to calculate its weighted average cost of capital. SOURCE OF CAPITAL Long-term debt Preferred stock Common stock Total REQUIRED: 1. what is the company's after-tax cost of debt? 2. what is the company's cost of preferred stocks? 3. what is the company's cost of retained earnings? AMOUNT 60,000 90,000 150,000 300,000 4. what is the company's weighted average cost of capital using retained earnings? 5. what is the company's weighted average cost of capital using new issue common stocks?

Step by Step Solution

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

1 Calculate the companys aftertax cost of debt cost of preferred stock and cost of retained earnings Where YTM on Bonds The yield to maturity on the bonds Tax Rate The corporate tax rate 40 in this ca...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started