Answered step by step

Verified Expert Solution

Question

1 Approved Answer

MTT Custom Classics uses a job costing system. Overhead is applied on the basis of direct material cost. The overhead rate used is 200%

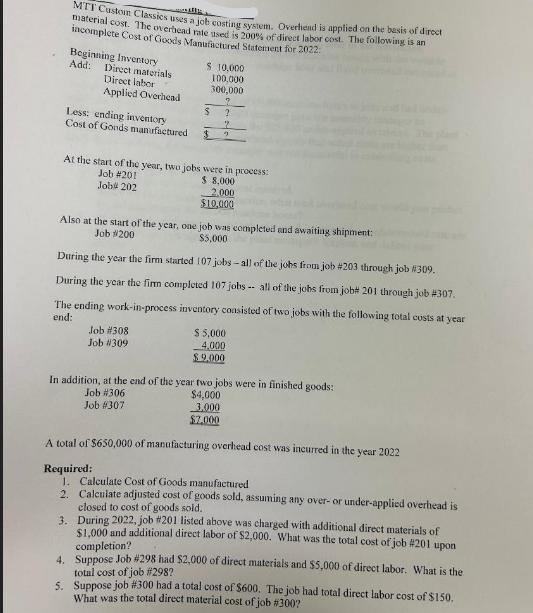

MTT Custom Classics uses a job costing system. Overhead is applied on the basis of direct material cost. The overhead rate used is 200% of direct labor cost. The following is an incomplete Cost of Goods Manufactured Statement for 2022 Beginning Inventory Add: Direct materials Direct labor Applied Overhead Less: ending inventory Cost of Gonds manufactured $ 10,000 100,000 300,000 ? $ ? 2 9 At the start of the year, two jobs were in process: Job #201 Job# 202 $ 8.000 2.000 $10,000 Also at the start of the year, one job was completed and awaiting shipment: Job #200 $5,000 Job #308 Job #309 During the year the firm started 107 jobs-all of the jobs from job #203 through job #309. During the year the firm completed 107 jobs- all of the jobs from job# 201 through job #307. The ending work-in-process inventory consisted of two jobs with the following total costs at year end: $ 5,000 4,000 $9.000 In addition, at the end of the year two jobs were in finished goods: Job #306 Job #307 $4,000 3,000 $7.000 A total of $650,000 of manufacturing overhead cost was incurred in the year 2022 Required: 1. Calculate Cost of Goods manufactured 2. Calculate adjusted cost of goods sold, assuming any over- or under-applied overhead is closed to cost of goods sold. 3. During 2022, job #201 listed above was charged with additional direct materials of $1,000 and additional direct labor of $2,000. What was the total cost of job #201 upon completion? 4. Suppose Job #298 had $2,000 of direct materials and $5,000 of direct labor. What is the total cost of job #298? 5. Suppose job # 300 had a total cost of $600. The job had total direct labor cost of $150, What was the total direct material cost of job #300?

Step by Step Solution

★★★★★

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

1 Calculate Cost of Goods Manufactured COGM Given that overhead is applie...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started