Question

Mugsy Brights Limited (MBL) is a private company in Winnipeg that sells mugs, jars and bottles in a variety of colours, sizes and materials. MBL

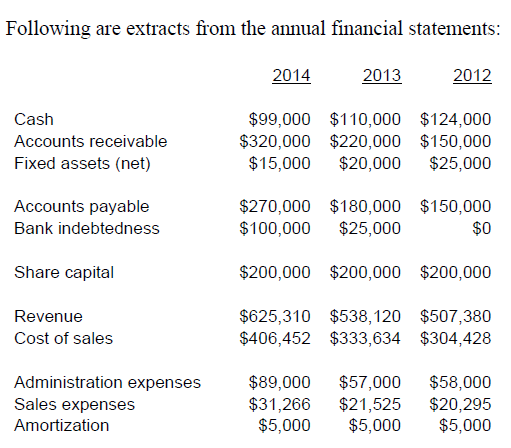

Mugsy Brights Limited (MBL) is a private company in Winnipeg that sells mugs, jars and bottles in a variety of colours, sizes and materials. MBL has been owned by four equal owners since inception. The owners have different skills creative design, marketing, finance and information systems. The company attributes much of its success to the use of materials that can be easily shipped without breaking, and unique designs that appeal to a variety of buyers, particularly commercial buyers who purchase for restaurants, or for businesses who choose to advertise their business by giving away or selling regular or travel mugs. The owners meet formally every month, and have informal meetings two or three times per week to discuss particular clients or new approaches. About a quarter of the sales are via the companys secure web site, while the remainder are by telephone or purchase order. MBL works with distributors of kitchenware, selling wholesale to hundreds of outlets in Canada. Most of these sales are done via the telephone, although a salesperson does spend some time in major cities across the country visiting some of the large customers, helping with shelf layout and marketing to the ultimate consumers for larger distributors. These efforts have resulted in gradually increasing market share for the company. The company web site is basically an information site, since most mugs are custom-designed. Repeat customers can order via the web site, though. All sales are recorded in the accounting software package used by the company. The accounting manager reports directly to one of the owners, and there are two other employees in the accounting department. Password controls are used to limit functions that are accessible by employees. For example, only the controller can implement wage rate increases or product price increases (which are reviewed and approved by the owner responsible for marketing). Two owners are required to sign cheques, and do so with source documents attached. Similarly, two owners are required to approve new employees. All manufacturing is outsourced to local producers who work with different materials. For example, a different supplier handles steel mugs versus plastics or glass. Ceramics is rarely used as it is quite breakable, whereas some forms of glass are very durable. MBL does not hold any inventory, as manufacturing is all done to order. However, as there have been some collection problems from customers, the company has had to go to the maximum of its line of credit, and has no additional borrowing capacity available. The owners have increased their own lines of credit and put some money into the company to keep it liquid. MBL is waiting for the results of the audited financial statements to approach the bank for an increase in its line of credit. Internet sales are prepaid (via credit card), while sales to distributors are net thirty. The company has an April year end.

A) What audit risk would you assign to the company? Why? [Tip: Do some basic calculations.] (5 marks) B) Assess risk of material misstatement (IR x CR). Justify your response. [Note that justifications must be different from Part A.] (5 marks) C) Calculate preliminary materiality. Justify your decision of materiality base and choice of materiality. (5 marks)

[ 111 [ 111Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started