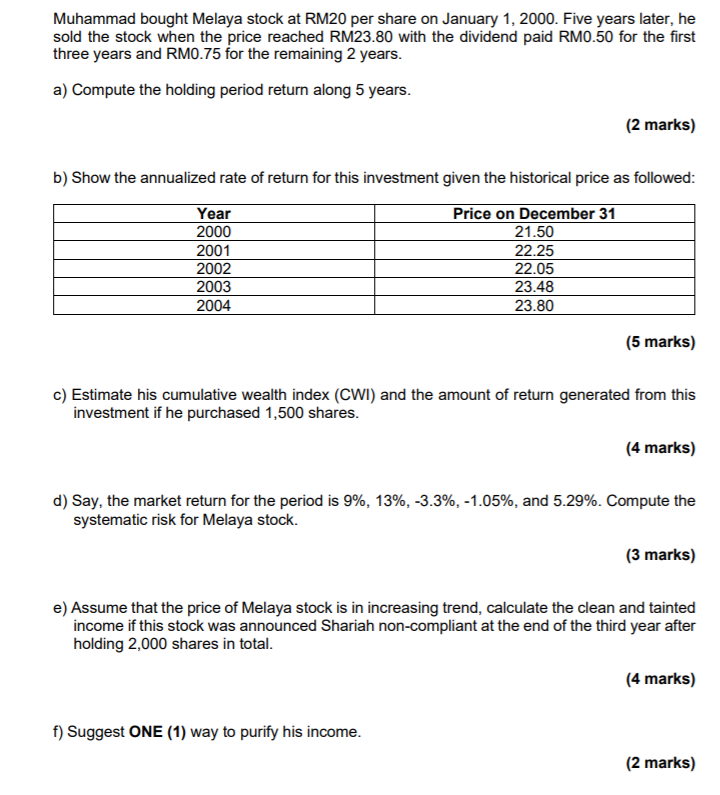

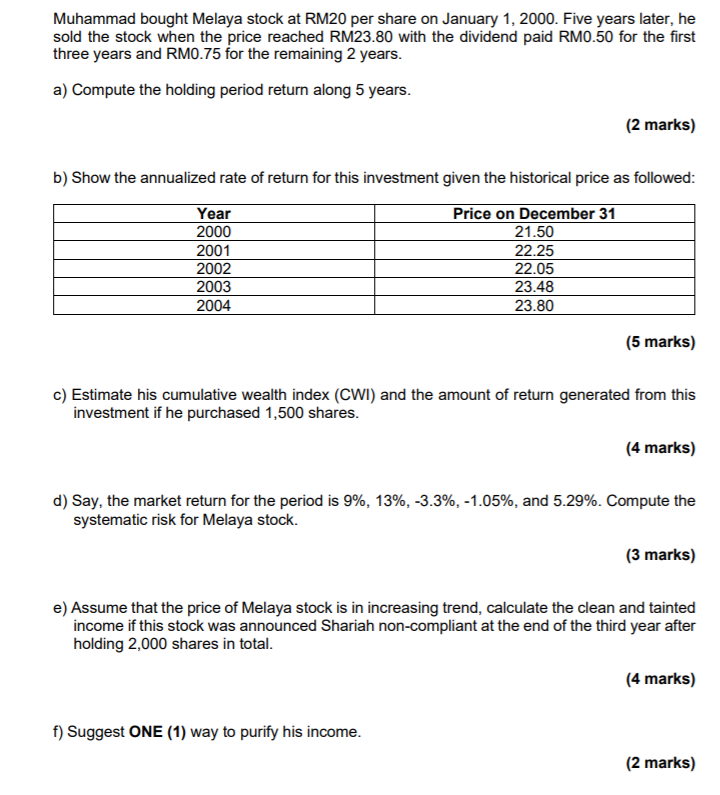

Muhammad bought Melaya stock at RM20 per share on January 1, 2000. Five years later, he sold the stock when the price reached RM23.80 with the dividend paid RM0.50 for the first three years and RM0.75 for the remaining 2 years. a) Compute the holding period return along 5 years. (2 marks) b) Show the annualized rate of return for this investment given the historical price as followed: Year 2000 2001 2002 2003 2004 Price on December 31 21.50 22.25 22.05 23.48 23.80 (5 marks) c) Estimate his cumulative wealth index (CWI) and the amount of return generated from this investment if he purchased 1,500 shares. (4 marks) d) Say, the market return for the period is 9%, 13%, -3.3%, -1.05%, and 5.29%. Compute the systematic risk for Melaya stock. (3 marks) e) Assume that the price of Melaya stock is in increasing trend, calculate the clean and tainted income if this stock was announced Shariah non-compliant at the end of the third year after holding 2,000 shares in total. (4 marks) f) Suggest ONE (1) way to purify his income. (2 marks) Muhammad bought Melaya stock at RM20 per share on January 1, 2000. Five years later, he sold the stock when the price reached RM23.80 with the dividend paid RM0.50 for the first three years and RM0.75 for the remaining 2 years. a) Compute the holding period return along 5 years. (2 marks) b) Show the annualized rate of return for this investment given the historical price as followed: Year 2000 2001 2002 2003 2004 Price on December 31 21.50 22.25 22.05 23.48 23.80 (5 marks) c) Estimate his cumulative wealth index (CWI) and the amount of return generated from this investment if he purchased 1,500 shares. (4 marks) d) Say, the market return for the period is 9%, 13%, -3.3%, -1.05%, and 5.29%. Compute the systematic risk for Melaya stock. (3 marks) e) Assume that the price of Melaya stock is in increasing trend, calculate the clean and tainted income if this stock was announced Shariah non-compliant at the end of the third year after holding 2,000 shares in total. (4 marks) f) Suggest ONE (1) way to purify his income. (2 marks)