Answered step by step

Verified Expert Solution

Question

1 Approved Answer

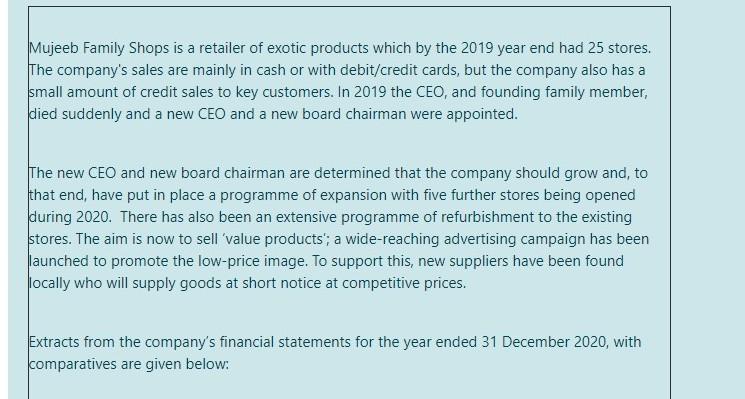

Mujeeb Family Shops is a retailer of exotic products which by the 2019 year end had 25 stores. The company's sales are mainly in cash

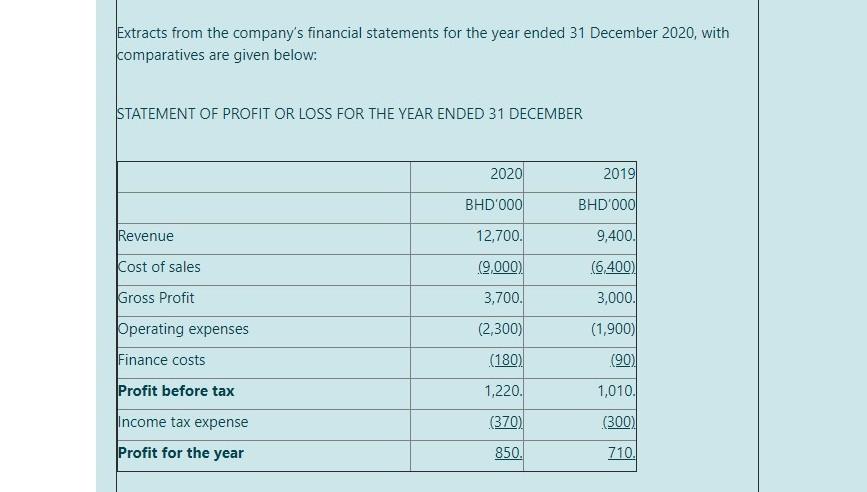

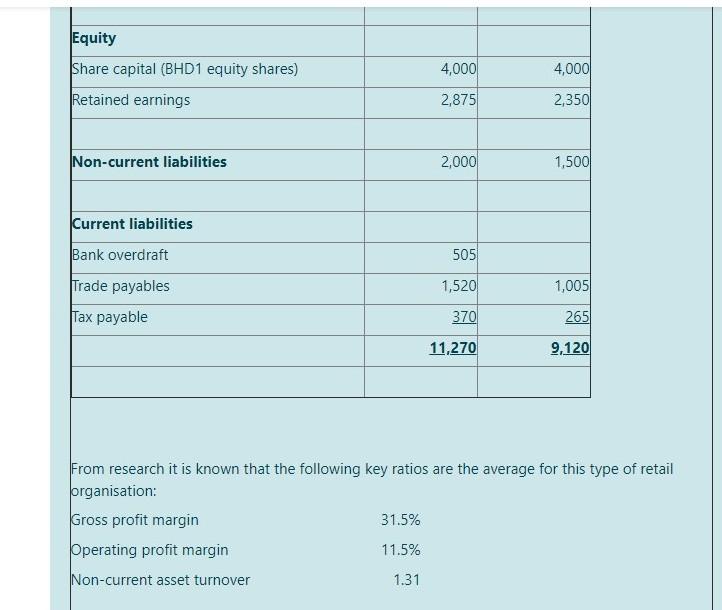

Mujeeb Family Shops is a retailer of exotic products which by the 2019 year end had 25 stores. The company's sales are mainly in cash or with debit/credit cards, but the company also has a small amount of credit sales to key customers. In 2019 the CEO, and founding family member, died suddenly and a new CEO and a new board chairman were appointed. The new CEO and new board chairman are determined that the company should grow and, to that end, have put in place a programme of expansion with five further stores being opened during 2020. There has also been an extensive programme of refurbishment to the existing stores. The aim is now to sell 'value products'; a wide-reaching advertising campaign has been launched to promote the low-price image. To support this new suppliers have been found locally who will supply goods at short notice at competitive prices. Extracts from the company's financial statements for the year ended 31 December 2020, with comparatives are given below: Extracts from the company's financial statements for the year ended 31 December 2020, with comparatives are given below: STATEMENT OF PROFIT OR LOSS FOR THE YEAR ENDED 31 DECEMBER 2020 2019 BHD'000 BHD'000 Revenue 12,700 9,400. (9,000) (6,400) 3,700. 3,000. (2,300) (1,900) Cost of sales Gross Profit Operating expenses Finance costs Profit before tax Income tax expense Profit for the year (180) (90) 1,220. 1,010. (370) (300) 850. 710. STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER 2020 2019 BHD'000 BHD'000 Non-current assets Property, plant and equipment 10,060 7,150 Current assets 1,050 1,300 Inventories Receivables 160 205 Bank 465 11,270 9.120 Equity Share capital (BHD1 equity shares) Retained earnings 4,000 4,000 2,875 2,350 Non-current liabilities 2,000 1,500 Equity Share capital (BHD1 equity shares) Retained earnings 4,000 4,000 2,875 2,350 Non-current liabilities 2,000 1,500 505 Current liabilities Bank overdraft Trade payables Tax payable 1,520 1,005 370 265 11,270 9,120 From research it is known that the following key ratios are the average for this type of retail organisation: Gross profit margin 31.5% Operating profit margin 11.5% Non-current asset turnover 1.31 Required (a) Calculate the following ratios (for both years) using the formulas given in brackets: 1) Gross Profit Margin (Gross Profit/Revenue * 100%) 2) Operating Profit Margin (Operating Profit/Revenue *100%) 3) Inventory Holding Period (Inventory Days: Inventory/Cost of sales * 365) 4) Current ratio (Current assets/current liabilities) 5) Non-current asset turnover (Revenueon-current assets) (5 Marks) (b) From the perspective of an investor, analyse the profitability, efficiency and liquidity of Mujeeb Family Shops based upon the information given and the ratios calculated in (a). The analysis report should include comparisons with the key sector ratios given above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started