Question

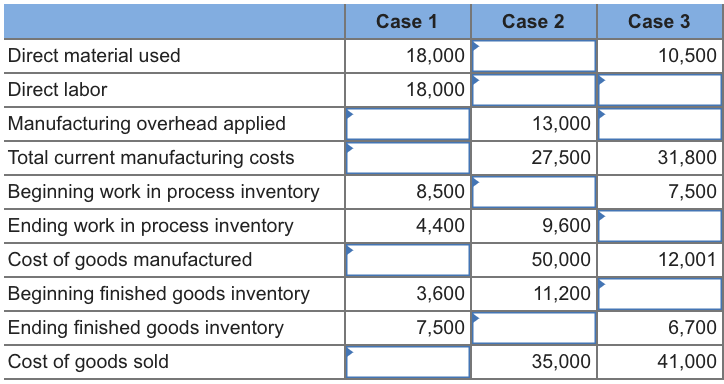

Mulligan Manufacturing Company uses a job order cost system with overhead applied to products at a rate of 150 percent of direct labor cost. Required:

Mulligan Manufacturing Company uses a job order cost system with overhead applied to products at a rate of 150 percent of direct labor cost. Required: Treating each case independently, selected from the manufacturing data given below, find the missing amounts. You should do them in the order listed. (Hint: For the manufacturing costs in Case 3, first solve for conversion costs and then determine how much of that is direct labor and how much is manufacturing overhead.) (Do not round your intermediate calculations. Round your final answers to the nearest whole dollar. Enter all amounts as positive values.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started