Question

Mullineaux Corporation has a target capital structure of 65 percent common stock and 35 percent debt. Its cost of equity is 12.3 percent, and

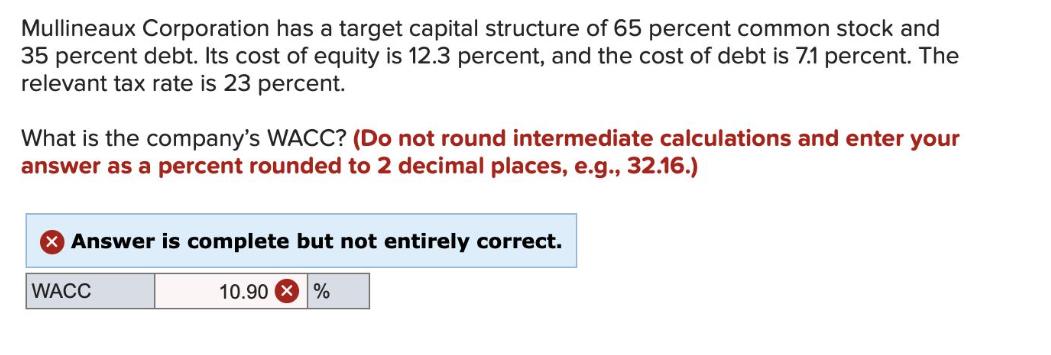

Mullineaux Corporation has a target capital structure of 65 percent common stock and 35 percent debt. Its cost of equity is 12.3 percent, and the cost of debt is 7.1 percent. The relevant tax rate is 23 percent. What is the company's WACC? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Answer is complete but not entirely correct. WACC 10.90 %

Step by Step Solution

3.56 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

You are absolutely right the previously provided answer 1090 contained ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Corporate Finance

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe, Gordon Roberts, Hamdi Driss

8th Canadian Edition

01259270114, 9781259270116

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App