Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Multi Investment Co.'s investment in Sherman Mfg. makes up 40% of Multi earnings and 30% of their assets. Robert Landry has an opportunity to

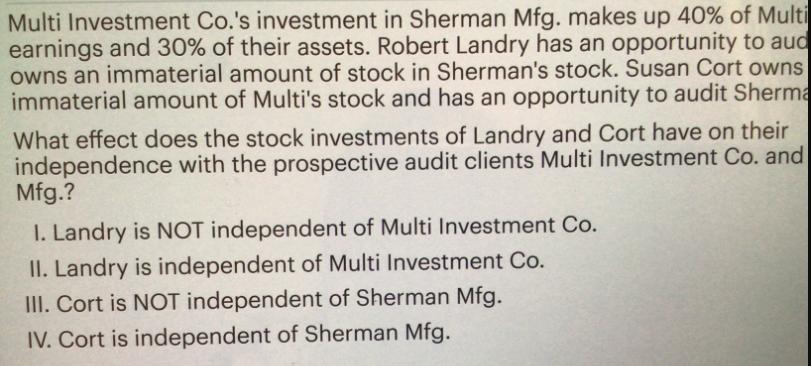

Multi Investment Co.'s investment in Sherman Mfg. makes up 40% of Multi earnings and 30% of their assets. Robert Landry has an opportunity to aud owns an immaterial amount of stock in Sherman's stock. Susan Cort owns immaterial amount of Multi's stock and has an opportunity to audit Sherma What effect does the stock investments of Landry and Cort have on their independence with the prospective audit clients Multi Investment Co. and Mfg.? 1. Landry is NOT independent of Multi Investment Co. II. Landry is independent of Multi Investment Co. III. Cort is NOT independent of Sherman Mfg. IV. Cort is independent of Sherman Mfg.

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

The stock investments of Landry and Cort can potentially affect their independence with respect to t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started