Answered step by step

Verified Expert Solution

Question

1 Approved Answer

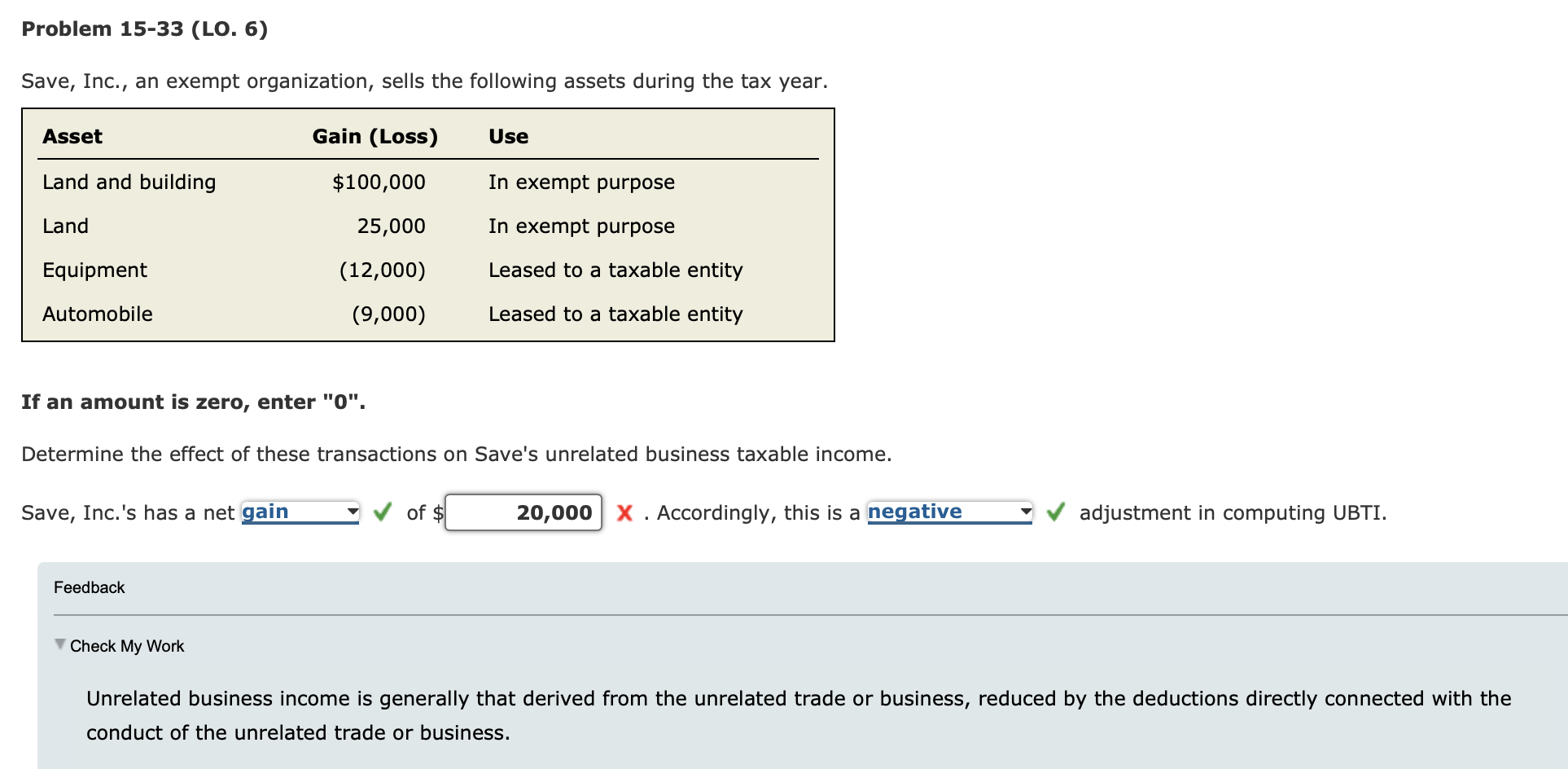

Problem 15-33 (LO. 6) Save, Inc., an exempt organization, sells the following assets during the tax year. Asset Gain (Loss) Use Land and building

Problem 15-33 (LO. 6) Save, Inc., an exempt organization, sells the following assets during the tax year. Asset Gain (Loss) Use Land and building $100,000 In exempt purpose Land 25,000 In exempt purpose Equipment (12,000) Automobile (9,000) Leased to a taxable entity Leased to a taxable entity If an amount is zero, enter "0". Determine the effect of these transactions on Save's unrelated business taxable income. Save, Inc.'s has a net gain of $ 20,000 X. Accordingly, this is a negative adjustment in computing UBTI. Feedback Check My Work Unrelated business income is generally that derived from the unrelated trade or business, reduced by the deductions directly connected with the conduct of the unrelated trade or business.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the effect of these transactions on Save Incs unrelated business taxable income UBTI we ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started