Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Multi Part Question, Needing help with #1a,b,c,d and e. Thank you! Question #1: Multi Parts a. What is the net operating cash flow in year

Multi Part Question, Needing help with #1a,b,c,d and e. Thank you!

Question #1: Multi Parts

a. What is the net operating cash flow in year 1?

- $50,000

- $45,000

- $46,121

- $26,064

- $25,122

b. What are the nonoperating cash flows in year 2 and 4?

- -$10,000 and $12,000

- -$12,000 and $23,000

- -$6,000 and $17,000

- -$6,000 and $25,000

c. What is the projects net cash flow in year 3?

- $50,000

- $16,161

- $46,762

- $16,761

- $35,145

d. What is the projects total net cash flow in year 4?

- $172,450

- $133,151

- $139,431

- $144,710

- $125,332

e. What is the NPV of replacing the old machine is a new machine?

- $136,740

- $118,436

- $141,310

- $132,227

- $125,655

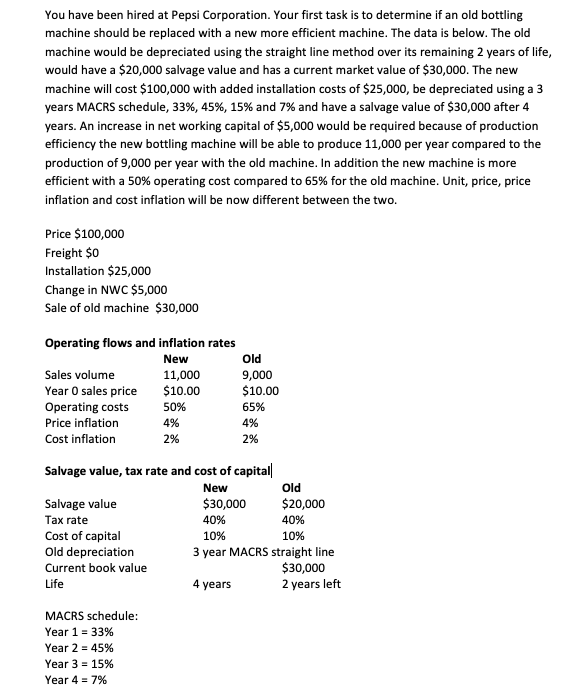

You have been hired at Pepsi Corporation. Your first task is to determine if an old bottling machine should be replaced with a new more efficient machine. The data is below. The old machine would be depreciated using the straight line method over its remaining 2 years of life, would have a $20,000 salvage value and has a current market value of $30,000. The new machine will cost $100,000 with added installation costs of $25,000, be depreciated using a 3 years MACRS schedule, 33%, 45%, 15% and 7% and have a salvage value of $30,000 after 4 years. An increase in net working capital of $5,000 would be required because of production efficiency the new bottling machine will be able to produce 11,000 per year compared to the production of 9,000 per year with the old machine. In addition the new machine is more efficient with a 50% operating cost compared to 65% for the old machine. Unit, price, price inflation and cost inflation will be now different between the two. Price $100,000 Freight $0 Installation $25,000 Change in NWC $5,000 Sale of old machine $30,000 Operating flows and inflation rates New Old Sales volume 11,000 9,000 Year 0 sales price $10.00 $10.00 Operating costs 50% 65% Price inflation 4% 4% Cost inflation 2% 2% Salvage value, tax rate and cost of capital New old Salvage value $30,000 $20,000 Tax rate 40% 40% Cost of capital 10% 10% Old depreciation 3 year MACRS straight line Current book value $30,000 Life 4 years 2 years left MACRS schedule: Year 1 = 33% Year 2 = 45% Year 3 = 15% Year 4 = 7%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started